The prices of gold coins in Ghana have fallen significantly since their launch, primarily due to the appreciation of the Ghanaian cedi against the US dollar.

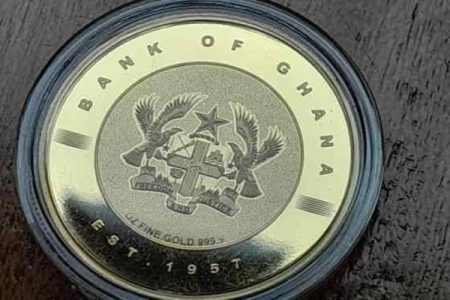

The Bank of Ghana’s (BoG) introduction of the Ghana Gold Coin (GGC) was aimed at diversifying investment options and absorbing excess liquidity, but recent developments have led to notable losses for buyers.

1.0 ounce Gold Coin

The 1.0-ounce gold coin, initially launched at GH₵45,020.48, is now selling at GH₵41,020.79, reflecting a price reduction of GH₵3,999.69.

0.50 ounce Gold Coin

The 0.50-ounce gold coin saw its price decline from GH₵22,409.74 at launch to GH₵20,913.03, marking a loss of GH₵1,496.71.

0.25 ounce Gold Coin

The 0.25-ounce gold coin experienced a smaller reduction, dropping from GH₵11,188.12 to GH₵10,889.09, a decrease of GH₵299.03.

Factors behind the price decline

At the time of the gold coins’ launch on November 27, 2024, pricing was based on the London Bullion Market Association (LBMA) PM gold price of $2,635.40 and a Bloomberg exchange rate of GH₵15.7500 to the US dollar.

As of the latest pricing update on Thursday, January 9, 2025, the LBMA gold price rose slightly to $2,659.65, but the cedi appreciated significantly to GH₵14.7350 against the dollar.

The GH₵1.015 gain in the cedi’s value compared $24.25 (GH₵357.32375) increase in the gold price, resulted in lower local prices for the gold coins.

Economic implications

The appreciation of the cedi signals growing stability in Ghana’s foreign exchange market, which positively impacts the economy. However, it has also reduced the valuation of assets priced in dollars, such as the Ghana Gold Coin.

The Bank of Ghana’s initiative to promote investment in Ghana’s gold reserves as part of its domestic gold programme aligns with broader efforts to strengthen the local currency and stabilize the economy.

The gold coins are designed as an alternative investment tool, absorbing excess liquidity and diversifying financial instruments available to the public.

Market analysts warn that while the cedi’s appreciation benefits some sectors, it could dampen enthusiasm for dollar-linked investments like gold coins.

This development underscores the delicate balance between monetary policies and their implications for investment and economic stability.

As the domestic gold programme continues, the BoG remains focused on creating financial instruments that drive economic resilience.

Market watchers will be keen to observe how these initiatives evolve amidst fluctuating global and local economic conditions.

- Friday, January 10, 2025 Newspaper Headlines - 10 January 2025

- Police restore calm at Newmont Mining site in Ntotroso - 10 January 2025

- CAF announces 75% increase in CHAN prize money - 9 January 2025