President Nana Akufo-Addo has rejected accusations of reckless borrowing and expenditure over the past six years.

Social amenities and infrastructure

According to him, the borrowed funds have been spent on projects and programmes that inured to the benefits of citizens in terms of providing social amenities and basic infrastructure.

Expenditure on key sectors

“Yes, I have been in a hurry to get things done, and this includes massive developments in agriculture, education, health, irrigation, roads, rails, ports, airports, sea defence, digitisation, social protection programmes, industrialisation, and tourism.

“We can be justifiably proud of the many things we have managed to do in the past six years,” he stated.

Not all debts contracted in 6 years

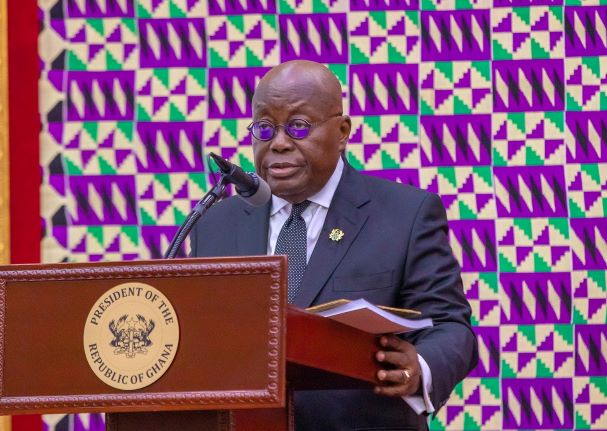

Delivering the State of the Nation Address (SONA) in Parliament, President Nana Akufo-Addo said the debts being serviced were not only contracted during the period of this administration.

SONA

SONA is in accordance with Article 67 of the 1992 Constitution of Ghana, which states that the President shall deliver a message on the SONA to Parliament at the start of each session and before the dissolution of Parliament.

SONA is a constitutional obligation and yearly tradition, wherein the Commander-In-Chief of the Ghana Armed Forces reports on the status of the country, unveils the Government’s agenda for the coming year, and proposes to Parliament certain legislative measures.

To that end, Article 67 of the 1992 Constitution of Ghana imposes an obligation on Members of Parliament, the Speaker, and the Judiciary to receive the President’s SONA.

President Nana Akufo-Addo said “We have spent money on things that are urgent, to build roads and bridges and schools, to train our young people and equip them to face a competitive world.

“Considering the amount of work that still needs to be done on the state of our roads, the bridges that have to be built, considering the number of classrooms that need to be built, the furniture and equipment needs at all stages of education, considering the number of children who should be in school and are not, considering the number of towns and villages that still do not have access to potable water, I daresay no one can suggest we have over borrowed or spent recklessly,” he stressed.

Innovative policies and execution of projects

President Nana Akufo-Addo is proud that his Administration has over the last six years championed innovative policies and execution of projects that have helped improved the quality of life of the Ghanaian people.

He pledged to continue on a path that brings the most benefit to the people of Ghana.

Built more roads

He boasted that his government has built more roads and constructed more railways than any government in the history of the 4th Republic.

Ghana Card, Zongo Development Fund

Beyond the construction of roads, he said, the New Patriotic Party (NPP) Administration had also implemented successfully a National Identification System with the Ghana Card, and also established the Zongo Development Fund to address the needs of Zongo and inner-city communities.

Access to toilet facilities

“We have constructed more infrastructure in the Zongo Communities than any other government in the Fourth Republic,” he stressed, adding that the Government had worked assiduously to increase the proportion of the population with access to toilet facilities from 33% to 59%.

Public libraries increased from 61 to 115

“There has also been an increase in the number of public libraries from 61 from independence until 2017 to 115 in 2022;” he said.

Retooling security agencies

President Nana Akufo-Addo said government had provided more equipment, that is, vehicles, ammunition, among others, to security services than any other government in the Fourth Republic, while successfully implementing the Digital Address System.

106 1D1F companies operational

On industrialisation, he said, in four years, 106 companies had been completed and in operation under the ‘One District, One Factory (1D1F).

148 1D1F factories under construction

According to him, 148 factories are under construction-the largest expansion of that sector since independence.

Largest medical drone delivery service saving lives

On health, he indicated that his Administration had introduced drones in the delivery of critical medicine, vaccines and blood to people in remote parts of the country.“Today, Ghana has the largest medical drone delivery service in the world with six Zipline Distribution Centres in Omenako, Mpanya, Vobsi, Sefwi Wiawso, Kete Krachi and Anum,” the President stated.

Rehabilitation and modernisation of large-scale irrigation schemes

On agriculture, the President said, in 2022, the Government completed the rehabilitation and modernisation of large-scale irrigation schemes at Tono, Kpong and Kpong Left Bank projects.

6,766 hectares of irrigable land

“The three schemes are expected to provide 6,766 hectares of irrigable land for all-year-round crop production,” he stated.

Tamne Irrigation Project

Phases One and Two of the Tamne Irrigation Project had also been completed, with Phase Three of the project at 57% completion.

$29.9 million worth of machinery and equipment

He said government has procured $29.9 million worth of machinery and equipment to boost agriculture mechanisation in Ghana.

He said government would this year, start preparatory works for the establishment of a Tractor and Backhoe Loader Assembly factory in the Ashanti Region and continuous capacity building of operators to ensure optimal management and lengthen the lifespan of agricultural machinery.

65 warehouses completed

President Akufo-Addo said the Government had constructed 65 warehouses, with 15 others at advanced stages of completion, to help address the vexed issue of post-harvest losses.

“This intervention is adding some eighty thousand metric tonnes (80,000mt) to national grain storage capacity,” he stated.

Decisions to save lives during COVID-19

President Nana Akufo-Addo said the government during the peak of COVID-19 on the African continent had to make decisions which based on science were the most reliable and trusted ways to save lives and livelihoods at the time.

According to him, though these decisions might look unnecessary and strange today, criminality or reckless spending cannot be ascribed to measures such as fumigation of public spaces, provision of GH₵518 million in grants and loans to Micro, Small and Medium-scale Enterprises (MSMEs) and preparing and distribution of hot meals to the vulnerable in society.

“In dealing with the crisis generally, I did not meet anyone brave enough to suggest that considerations of money should be a hindrance to anything we needed to do in the fight against the virus,” he said.

COVID-19 funds audit

The President also noted that the importance of not losing public confidence during the challenging times led the government to ask for the audit of the COVID funds.

COVID-19 funds used well

“And I can assure this House that nothing dishonourable was done with the COVID funds. The responses from the Ministers for Health and Finance, on January 23 and 25, 2023, respectively, have sufficiently laid to rest the queries from the Auditor General’s report.

“No auditor can put a figure on the cost of keeping the children in school safely during that crisis, nor the continuing cost of the effect of the pandemic on our young people; not the financial cost, not the emotional cost, and certainly not the social cost,” the President said.

International Monetary Fund

President Nana Akufo-Addo announced that the International Monetary Fund (IMF) staff will present Ghana’s request for a loan programme to its executive board by the end of the month.

Ghana secured a staff-level agreement with the IMF in December for a $3 billion loan, but approval is contingent on it restructuring its debt of GH₵575.7 billion ($47.6 billion).

“We are on course for the IMF staff to present to the IMF executive board Ghana’s programme request for a $3 billion extended credit facility by the end of the month,” he added.

COVID-19, Russia-Ukraine war, soaring energy and food prices, higher interest rates, a strong dollar and a global slowdown negatively affected the economy.

President Nana Akufo-Addo explained that prior to the onset of the exogenous forces, his administration in three years reduced inflation to its lowest level (7.8% in January 2020) since 1992.

He added that for the first time in over 40 years, government recorded a fiscal deficit below five percent of Gross Domestic Products (GDP) for three years in a row.

For the first time in over 20 years, he stated that the balance of trade (that is the difference between our exports and imports) has been in surplus for three consecutive years.

He stated that current account deficit is shrinking, interest rates declining, and the average annual rate of depreciation of the cedi was at its lowest for any first term government in the Fourth Republic.

He recalled that economic growth rebounded to place Ghana among the fastest growing economies in the world for three years in a row at an annual average of 7%, up from 3.4% in 2016, the lowest in nearly three decades.

“The international investor community has recognised this development, resulting in Ghana, today, being the largest recipient of foreign direct investment in West Africa.

“The sovereign credit ratings agencies upgraded ratings, and also improved the outlook for this year, notwithstanding the fact that it is an election year,” he stressed.

Turning to security issues, the president said that while he did worry about the extraordinary expenditure on security at the country’s borders, Ghana had no choice but to spend resources to keep its borders safe.