Energy experts Kofi Ansah and Fui Tsikata have conducted a joint analysis of Ghana’s Lithium deal, concluding that, overall, the deal is beneficial.

The experts highlighted two areas where they believe improvements could be made to the terms of the Lithium deal but argued that three widely-publicized criticisms are patently incorrect.

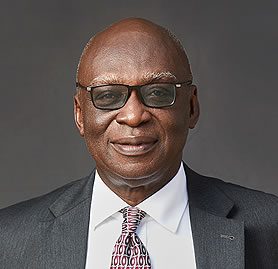

Mr. Fui Tsikata, is a former lecturer of the University of Ghana Faculty of Law, and a legal luminary of many years of experience in the mining industry, spanning over 40 years, while Mr. Kofi Ansah is the founding Chief Executive Officer of the Minerals Commission, under President Rawlings, from 1993 to 1999.

In October this year, Government granted a mining lease to Barari DV Ltd, a subsidiary of Atlantic Lithium Ltd, for the exploitation of lithium in Ghana.

According to the Lithium deal, half of the concentrate, with a lithium oxide content of 6% (SC6), will be sold through an off-take agreement to a US company, Piedmont, which has significant ownership interest in the Ewoyaa project.

The other half, with a lithium oxide content of 5.5%, will be sold to other buyers.

Ansah and Tsikata acknowledged the need for stringent measures to ensure the best prices are obtained, as government royalties, the growth and sustainability levy, and income tax liability will be calculated based on the company’s gross revenue earnings.

They emphasized that the government should insist on reviewing the provisions of the off-take agreements under which the concentrate will be sold to Piedmont.

The experts suggested to the government to either engage a commodities research company to regularly provide prices—both open market and contract prices between unaffiliated companies—for guidance or have a side agreement with the company, allowing for the engagement of an independent and reputable firm to provide current data on prices used for gross revenue determination.

On the possibility of establishing a plant to convert concentrate into lithium hydroxide or lithium carbonate, Ansah and Tsikata emphasized that it should be explicitly stated that the obligation is to make the concentrate available to any Ghanaian plant on terms no less favorable than those on which the mine supplies any other customer, including its shareholder/customer.

This, they believe, would be a crucial step toward achieving value addition in the country.

IEA, supported by former Chief Justice Sophia Akuffo, proposed that “joint venture” agreements or “service contracts” are better legal vehicles than mining leases or concessions, characterizing the latter as colonial forms.

Ansah and Tsikata, however, criticized this perspective, stating that it promotes form over substance.

They corrected the wrong computations of revenue by the Institute of Economic Affairs (IEA) and Professor Ransford Gyampo of the University of Ghana under Ghana’s current mining lease.

The experts argued that the methods used by IEA and Prof. Ransford Gyampo contain fundamental flaws, undermining the conclusions drawn and potentially leading to over estimation of potential revenue from the Lithium deal.

They explained that the main product exported from the project is spodumene concentrate, measured in terms of lithium oxide content.

The feasibility report indicates that half of the exported concentrate will contain 6% lithium oxide (SC6).

For an annual production of 160,000 tonnes, even if all production were SC6, the lithium oxide content would be 9,600 tonnes per year.

The energy experts explained that lithium compounds are priced by reference to lithium carbonate prices, converting the specific lithium compound to its lithium carbonate equivalent (LCE) in weight.

For lithium oxide, they said the conversion factor is 2.473, meaning one tonne of lithium oxide is equivalent to 2.473 tonnes of lithium carbonate.

Therefore, 160,000 tonnes of spodumene concentrate with a 6% lithium oxide grade (9,600 tonnes) would be equivalent to 23,712 tonnes per annum of lithium carbonate.

If the price of lithium carbonate is $29,000 per tonne, the gross revenue per year would be $29,000 × 23,712, or $688 million, significantly less than the $24 billion claimed by the critics.

The experts applied a simplified model computation of royalty, levy, income tax, and dividend, revealing that the government takes 51% of the available direct project monetary benefit, while investors receive 49%.

Responding to calls for a joint venture, Ansah and Tsikata argued that a service contract, where the government pays the contractor 60% of mining revenues and retains 40%, would be less beneficial than a concession contract with a 50:50 distribution of direct monetary benefits.

They questioned the criteria for characterizing a project as a joint venture, asking whether majority shareholding is required and what other factors are relevant.

They also considered whether the government should take the risk in mine development or engage contractors with no legal rights in what is mined.

On IEA’s call for developing policies for lithium mining and value addition, the experts agreed that it extends beyond the Ewoyaa project, suggesting the importance of implementing such policies not only for lithium but also for other green minerals.

They emphasized the need for feasibility studies, citing the example of bauxite reserves at Kyebi and Nyinahin in the 1970s.

While supporting the idea of improving the country’s bargaining position in negotiations with mining companies, Ansah and Tsikata expressed caution about the premature establishment of a Ghana Lithium Company.

They suggested conducting feasibility studies under the auspices of existing institutions to avoid creating a new entity with the potential for wasteful expenditure.

- Minority urges govt to act swiftly on Bawku security crisis - 12 April 2025

- Utility tariff hikes: Electricity-14.75%, Water-4.02% - 12 April 2025

- Empowering ECG, NEDCO in electricity supply without privatization - 11 April 2025