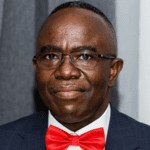

Chief Executive Officer (CEO) of defunct Capital Bank, William Ato Essien, has been sentenced to 15 years imprisonment for stealing GH₵90 million.

It consists of GH₵27.5 million allocated to business promotion, GH₵30 million which prosecution said could not be accounted for and GH₵32.5 million as reparation, restitution and interest.

When he was found guilty and given suspended sentenced, he was prohibited from holding any key position in any bank or financial institution.

At the time, Essien had earlier paid GH₵30 million to the state.

This was after he had changed his plea of not guilty to guilty on 16 counts of Conspiracy to steal, stealing and money laundering on December 13, 2022.

The court, however, suspended his sentence after the court accepted an agreement between Essien and the state in relation to Section 35 of the Court’s Act.

Section 35 of the Court’s Act allows a party to pay or refund money stolen from the state with interest. It also affords the accused from doing jail term when found guilty.

Timelines for payment

He was expected to pay an outstanding amount of GH₵60 million in three instalments of GH₵20 million on April 20, 2023, August 31, 2023, and December 15, 2023.

GH₵5m paid

But, he was only able to pay GH₵5 million.

GH₵55m left to be paid

Which meant that Essien has paid GH₵35 million out the GH₵90 million and is left with GH₵55 million to pay.

In May, Essien was given up until July 4 to liquidate his assets and pay the state GH₵55 million but this deadline elapsed without any payments made.

Essien’s failure to refund the entire amount led the state to file an application seeking his incarceration in May 2023.

Essien would have served a total of 95 years on some 23 counts slapped on him by the Court but his partial refund of the money and other mitigating factors were considered. Additionally, some of the sentences will run concurrently.

Sentence handed down

The Court in handing down the sentence noted that stealing Essien was not an ordinary one; as his action led to the collapse of the bank.

According to the Court, the monies were moved from Capital Bank in Jute bags to set up Sovereign Bank, adding that, the action of Essien led to pain and tears, and people lost their jobs.

It said those who lost their jobs were still engaged in job hunting.

The Court noted that huge sums of money were lost and the State had to spend huge sums of money to bail out depositors.

According to the Court, the convict took advantage of the fact that he was a majority shareholder of the defunct bank and demonstrated greed by establishing the Sovereign Bank.

It said that it had been magnanimous to Essien by granting him several opportunities to pay the money.

The trial Judge, Justice Eric Kyei Baffour, a Court of Appeal Judge, emphasised that the Court had granted Essien several opportunities to make payments under the law, adding that, at the last adjourned date the Court did not sit and it did not sit during the legal vacation.

“One would think that the convict respondent would take advantage of the two months legal vacation and make some payment,” he noted.

Senior State Attorney

The State, led by Mr Joshua Sackey, a Senior State Attorney, being led by Mr Richard Gyambiby, Principal State Attorney, moved the application for the imposition of custodial sentence on Essien, after failing to pay his outstanding amount of GH₵55 million to the State.

Mr Sackey held that per the agreement of the Republic and the convict respondent under Section 35 (7) of the Court Act, Essien agreed to pay GH₵90 million.

According to Mr Sackey, the Court adopted the said agreement, but Essien had failed to abide by the terms of the agreement.

“Per their showing, the convict respondent (Essien) will not be able to fulfil his obligations. As a result of this we pray the court to pass a custodial sentence on the convict respondent as he has violated Section 35 (7) of the Court’s Act.”

Defence Counsel

Defence Counsel Baffour Gyau Bonsu Ashia, who held the brief of Thaddeus Sory, however, opposed to the application of the State on two grounds.

According to Mr Ashia, the application was premature and same did not invoke the inherent jurisdiction of the court.

According to Defence Counsel, his client had demonstrated to the Court that he would be able to pay the outstanding balance of GH₵55 million when given some time.

He, therefore, prayed the court to give him six more months to pay the balance, saying that although his client had not been working after the collapse of the bank, he had not been sleeping.

The Defence Counsel recounted that his client’s passport had been seized by the court, saying that had made things difficult for his client to mobilise funds in and outside Ghana in order to make payments.

The Counsel recounted some challenges his client had had after a judgement was obtained against him in respect of some properties located at Prampram in the Greater Accra Region.

He said that but with the said judgement, Essien would have sold some properties in order to make some payments.

The Counsel said imposing a custodial sentence on Essien would defeat the purpose and spirit of the Section 35 (7) of the Court’s Act.

He, therefore, prayed the Court to tamper justice with mercy and grant Essien some time to pay the outstanding balance.

Essien was jailed for misappropriating millions of cedis offered by the Bank of Ghana in the year 2015 and 2016 as liquidity support to Capital Bank.

Breakdown of how Capital Bank misapplied GH₵620

The case of the state is that between June and November 2015, pursuant to an application by Capital Bank, BoG provided a total sum of GH₵620 million as Liquidity Support to Capital Bank to enable it to meet its capital adequacy ratio as well as enable it service the maturing debt of meditation.

GH₵120 transferred to All Time Capital Limited

Prosecution said in October 2015, Essien, aided by Rev Odonkor, caused a transfer of a sum of GH₵120 million of the Liquidity Support to All Time Capital Limited, an investment management and advisory firm.

GH₵100m transferred to MC Management Services

The state said at the instance of Essien and Odonkor, GH₵100 million of the GH₵120 million, which had been transferred to All Time Capital, was further transferred to MC Management Services.

GH₵20m transferred to Pronto Construction

The remaining GH₵20 million of the amount was transferred to Pronto Construction and Supplies Limited.

GH₵100m used as capital to set up Sovereign Bank

According to Prosecution, the GH₵100 million, which was transferred to MC Management Services, was subsequently represented by Nettey to BoG as initial capital of Sovereign Bank while the GH₵20 million that was transferred to Pronto Construction and Supplies Limited was used by its Managing Director, ostensibly to purchase shares in Capital Bank.

GH₵65m transferred to Nordea Capital Limited

Prosecution said again, at the instance of Essien and Rev Odonkor, GH₵65 million out of the BoG’s Liquidity Support of GH₵620 million was transferred to Nordea Capital Limited, described as an investment bank.

GH₵30m transferred to MC Management Services

The State averred that of the GH₵65 million, Essien, aided by Odonkor, caused GH₵30 million to be transferred to MC Management Services, which was represented to the BoG as additional initial capital of Sovereign Bank by Nettey.

GH₵35m transferred to Bristling Services

The remaining GH₵35 million being paid into Fidelity Bank Account of Bristling Services, a company established by Essien.

GH₵35m again transferred to Capital Africa Group

At the request of Essien, the GH₵35 million, which was transferred into the Bristling Account, was subsequently transferred to Capital Africa Group, a company owned by Essien.

GH₵130m then transferred to Capital Africa Group

Prosecution said the total amount of GH₵130 million represented as initial capital of Sovereign Bank was eventually channeled by Essien and Nettey into Capital Africa Group with less bank charge, and which they eventually dissipated.

GH₵27.5m allocated to business promotion

Between June 2015 and October 2016, Essien, with the support of Rev Odonkor, appropriated a total of GH₵27.5 million of the Liquidity Support, which was conveyed in jute bags to Essien and purportedly used as payment for business promotion.

GH₵100m paid to MDs of 3 companies

Prosecution said in June 2017, in furtherance of the conversion of the portion of GH₵620 million Liquidity Support, Essien caused GH₵100 million to be paid into a Capital Bank Account held by the Managing Director of three companies; Mariposa Enterprise Limited, Hardwick Limited and Volta Impex Enterprise Limited.

The state submitted that the three companies were purposely to receive the amount (GH₵100 million).

Prosecution said that amount was to be used by the Managing Director ostensibly as payment for 30% shares in Capital Bank.

Prosecution said Essien prevailed on the Managing Director to submit copies of government payment certificates of the three companies valued at GH₵135 million to be discounted at GH₵105 million by Capital Bank, and to be used as collateral for the purported loan of GH₵100 million.

GH₵70m transferred to account of Kate Papafio

The State said Essien then caused GH₵70 million out of the GH₵100 million that had previously been paid into the Managing Director’s account at Capital Bank to be transferred to Kate’s account at CAL Bank Limited.

Prosecution said Essien and Kate subsequently caused the GH₵70-million to be further transferred into Kate Papafio’s personal account at Capital Bank, adding that the account was purposely opened to receive the amount.

Sometime in 2017, prosecution said after Capital Bank had received the money, Papafio, even though fully aware that Capital Bank had gone into liquidation, attempted to withdraw the whole amount of GH₵70 million but was, however, prevented by the receivers (Capital Bank).

Essien was jointly charged with two others.

Essien’s accomplices namely Tetteh Nettey, Managing Director of MS Management Service, a company allegedly established by Essien and Rev. Fitzgerald Odonkor, former Managing Director of Capital Bank were acquitted and discharged by the court.

The court found them not guilty on the various charges of abetment of crime, conspiracy to steal and stealing and ordered the Registrar of the court to release their passports to them.

- Dr. Boako criticizes Finance Ministry-BoG disconnect - 29 March 2025

- BoG raises policy rate from 27% to 28% - 29 March 2025

- Mahama gives CJ 10-Day ultimatum to respond to petitions - 29 March 2025