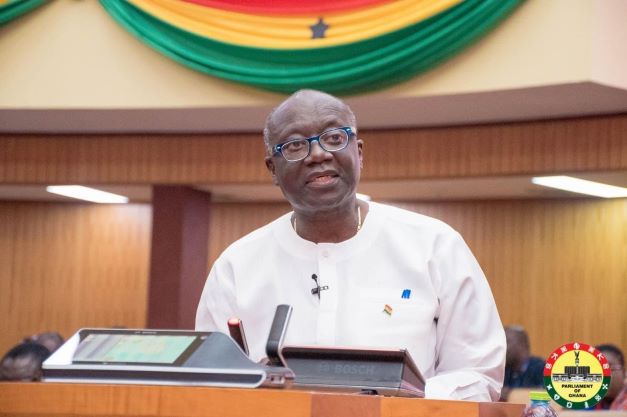

Ofori-Atta appeals to Parliament to approve revenue measures

Finance Minister Ken Ofori-Atta has informed parliament of his intention to present necessary fiscal adjustments to the house in august after the debt operation is completed.

Outstanding revenue mobilisation bills

Already, he said the Income Tax (Amendment) Bill, Excise Duty & Excise Tax Stamp (Amendment) Bills as well as the Growth and Sustainability Levy Bill, are outstanding in Parliament.

According to him, the consideration and approval of fiscal measures by Parliament are critical for recovery from the current economic crisis.

Facilitating IMF Board approval

The Minister therefore entreated Parliament to prioritise the approval of the outstanding revenue mobilisation bills to facilitate the Board Approval for International Monetary Fund (IMF) Programme staff level agreement by the end of March, 2023.

“We are still counting on you for the passage of all the outstanding revenue Bills which are necessary for effective Budget Implementation as well as boosting our efforts at increasing our Tax-to-GDP from less than 13% to the sub-Saharan average of 18,” he stated.

Expected impact of IMF Board approval

He is confident IMF Board approval will restore macro-economic stability, ensure debt sustainability as well as provide critical social protection for the benefit of Ghanaians.

Factors that impacted economy negatively

COVID-19, Russia-Ukraine war, soaring energy and food prices, higher interest rates, a strong dollar and a global slowdown negatively affected the economy.

Ghana seeking $3 billion loan

Ghana and the International Monetary Fund (IMF) have reached staff-level agreement on economic policies and reforms to be supported by a new three-year arrangement under the Extended Credit Facility (ECF) of about $3 billion.

But, the IMF has made it clear that the Board approval of the deal is contingent on a successful debt exchange programme.

Broader govt response strategy

Addressing Parliament on the ongoing debt restructuring efforts, Ofori-Atta explained that debt operations are a composite part of a broader government response strategy for addressing the current challenges.

While being optimistic about IMF programme to boost confidence in the economy, he emphasized that complementing it with enhanced domestic mobilisation efforts is critical.

4 out of 5 agreed Prior Actions in the Staff Level Agreement

The Finance Minister averred that the passage of the Bills will enable government to complete four out of five agreed Prior Actions in the Staff Level Agreement.

Agreed Prior Actions already implemented

He noted that tariff adjustment by the Public Utilities Regulatory Commission (PURC), Publication of the Auditor-General’s Report on COVID-19 Spending, and Onboarding of Ghana Education Trust Fund (GETFund), District Assemblies Common Fund (DACF) and Road Fund on the Ghana integrated financial management information system (GIFMIS) have all been completed.

International and domestic bond markets are shut

Ofori-Atta reminded the legislators that the international and domestic bond markets are shut for the financing of government’s programmes, forcing government to rely on the Treasury Bills and concessional loans as the primary sources of financing for the 2023 fiscal year.

Therefore, he called on Parliament to support the government’s financing requests to ensure a smooth recovery from the economic challenges.

He thanked everyone who tendered and supported the Domestic Debt Exchange programme saying “It is a truly remarkable act of sacrifice in our nation’s history. We thank those who heeded our clarion call and took the selfless, patriotic decision to participate. Your names and deeds will never be forgotten. Your timely support is deeply appreciated,”.

He is confident that the programme government has set out for this year, supported by Parliament, will get Ghana out of the economic crisis that has hit the economy since Covid-19.

Inflation interest and exchange rates to stabilise

He hopes for stability in the exchange rates, inflation and interest rates, bringing businesses and families some respite.

Suspension of payments of interest on foreign debt

Government also announced a suspension of all debt service payments for certain categories of external debt, pending an orderly restructuring.

International bondholders

Ofori-Atta revealed that Ghana initiated discussions with representatives of international bondholders and their Advisors.

According to him, substantive discussions are due to start with them in the weeks to come.

G-20 Debt Treatment initiative

Ghana officially asked its bilateral creditors for a Debt Treatment initiative under the G-20 Common framework.

Negotiations with commercial creditors underway

The Finance minister said the process of negotiations have started in good faith with commercial creditors.

Ofori-Atta stated that two preliminary discussions and exchange of information have started on a good footing with representative committees and advisors.

Creditor Committee to assess Ghana’s request

According to him, the members have indicated their commitment to establish a Creditor Committee to assess Ghana’s request for debt treatment under the Common Framework by end February, 2023.

- Monday, May 12, 2025 Newspaper Headlines - 12 May 2025

- With honour culture, Mahama wouldn’t need appointee Code - 12 May 2025

- Dollar role under pressure from portfolio rebalancing - 11 May 2025