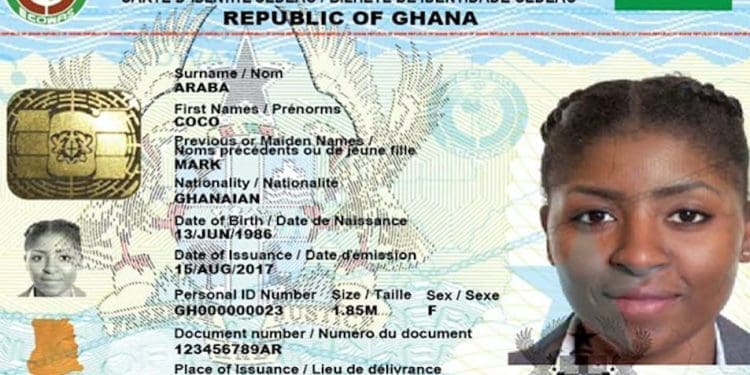

The Bank of Ghana (BoG) has mandated the Ghana Card as the sole form of identification for all financial transactions, with immediate effect.

The central bank said the revised Supervisory Guidance Note replaced all previous versions and introduced a mandatory requirement for customer identification and verification.

BoG stated that customers without a Ghana Card, or the applicable Non-Citizen or Refugee Identity Card, would be prohibited from undertaking any financial transaction.

The directive requires all accountable institutions to use the National Identification Authority (NIA) system to onboard new customers, including citizens, permanent residents and ECOWAS nationals.

For digital channels, including mobile applications, the Bank said a mandatory liveness check would apply to all customers to strengthen fraud prevention in non-face-to-face transactions.

On account access, the guidance allows third parties to deposit funds into accounts that have not been updated, but account holders would be restricted from making withdrawals until a Ghana Card is provided.

Banks have been authorised to update secondary customer information, such as telephone numbers and addresses, using NIA records, while corrections to primary data, including names and dates of birth, would require customers to visit the NIA in person.

The Bank provided limited exceptions for non-residents and Ghanaians abroad, stating that non-residents staying for less than 90 days may use passports for one-off transactions, including ATM withdrawals and remittances, subject to visa details.

It added that Ghanaians living abroad who do not yet have access to the Ghana Card may temporarily use their passports.

In cases where biometric verification fails due to technical issues or “No Match” results, the Bank said a 90-day deferral period would apply for new customers to rectify their records, during which affected accounts would remain non-operational.