With the inauguration of the Kasoa Bulk Supply Point (BSP), the United States has completed its nearly six-year $316 million investment in Ghana’s energy infrastructure, supporting more reliable power for hundreds of thousands of schools, hospitals, offices, and homes in Ghana.

The Millennium Challenge Corporation (MCC) Ghana Power Compact end date is June 6, 2022.

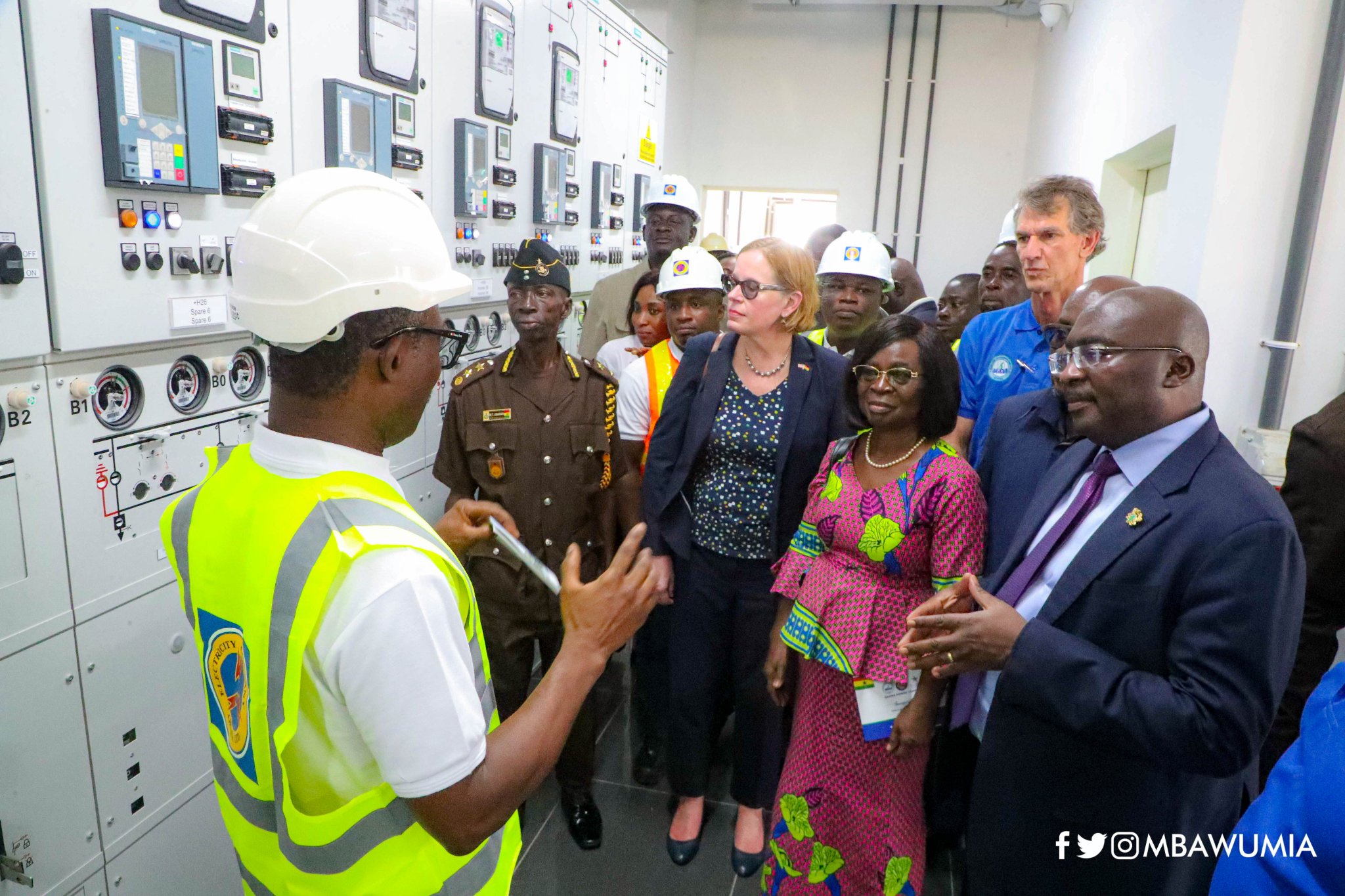

Nicole Chulick, Deputy Chief of Mission of the US Embassy

The Deputy Chief of Mission of the US Embassy, Nicole Chulick, joined Vice-President Dr Mahamudu Bawumia and other Ghana government officials to formally inaugurate the Kasoa Bulk Supply Point (BSP).

The US government funded the $50 million power substation as part of the MCC-Ghana Power Compact.

“With the inauguration of the Kasoa Bulk Supply Point here today, we mark the successful completion of the Millennium Challenge Corporation (MCC) Ghana Power Compact,” Chulick said.

“This was a nearly six-year, $316 million commitment by the American people to improve Ghana’s energy infrastructure and support long-term economic growth,” Chulick said during the inauguration event.

Commissioning the facility, Dr Bawumia said it is one of the many electricity infrastructures constructed as part of the ECG’s Financial and Operational Turnaround Project under the Ghana Power Compact II.

It has a $316-million funding from the MCC, an independent agency of the United States government’s foreign initiative, and a $31 million counterpart funding from the Government of Ghana.

$863m US MCC investments in vital infrastructure since 2012

He said the US government, through the MCC, had invested $863 million in vital infrastructures in Ghana for the duration of the two power compact programmes from 2012 to date, which had added a wealth of support to the country’s infrastructure requirements.

Dr Bawumia expressed the Akufo-Addo government’s determination to ensure robust, sustainable and reliable power supply to households and businesses pivotal towards the country’s industrialisation drive.

This will also help ECG’s power transmission operations and distribution network and aid in minimising technical losses.

Dr Bawumia said the government was undertaking several power infrastructure projects to meet the power demand of the ever-increasing population, saying those projects should be sustained even after the Power Compact Agreement.

The Board Chair of the Millennium Development Authority (MiDA), Professor Yaa Ntiamoa-Baidu, in her welcome remarks, said the facility would enhance productivity, incomes and social outcomes for residents in the catchment area.

“Out of the 230 key staff and employees who worked on the project, 90 per cent are Ghanaians while 16 per cent are females,” she said, noting that it helped in the transfer of essential knowledge and technology to Ghanaians.

Parts of the support fund for the project were also used to construct access roads, walkways and drainage system at the project site.

Following the event, Chulick toured the new facility with Vice-President Dr Bawumia.

New power infrastructure and reforms

The $316-million MCC Ghana Power Compact invested in new power infrastructure and reforms to provide more reliable, affordable electricity to Ghanaians.

It also supported programmes designed to improve energy efficiency and expand opportunities for women in the power sector.

Ghana loses $190m grant over cancelled power contract

The United States government has cancelled $190 million in grants to Ghana under the “Power Africa” initiative in response to government’s termination of a contract with a private utility provider Power Distribution Services (PDS).

The MCC agreed in 2014 to provide $498 million in funding to Ghana’s power sector to help stimulate further private investment.

One reform under the agreement involved handing over operations at ECG in to PDS, a consortium led by Philippine electricity company Meralco.

But the Finance Minister informed US officials that the government terminated the 20-year concession it had signed with PDS, saying payment guarantees provided were not satisfactory.

The US government said the decision to terminate the contract was unjustified and that the MCC cancelled $190 million in grants.

Energy infrastructure improvements

The MCC Ghana Power Compact successfully improved the country’s power sector through the construction of four power substations: the Pokuase BSP, the Kasoa BSP, the University of Ghana Medical Centre Primary Substation at Legon and the Ellen Moran Primary Substation at Kanda.

These new power substations directly serve the 37 Military Hospital, Greater Accra Regional Hospital, University of Ghana Medical Centre, Noguchi Memorial Institute for Medical Research, the National Mosque and over 800,000 utility customers.

Compact projects upgraded the power system in 10 markets in Accra and Tamale.

$50m Kasoa Bulk Supply Point

The inauguration of the Kasoa BSP marks the final major milestone under the MCC Ghana Power Compact and successful completion of the programme that has benefited hundreds of thousands of Ghanaians.

The 435-mega volts amperes (MVA), second largest in the country after the Pokuase BSP, will supply power to households and businesses to improve productivity and living conditions within Kasoa, Senya Breku, Bawjiase, Nyanyano, Tuba and Tokuse, as well as complement the Winneba and Mallam power substations.

The 435-megavolt ampere (MVA) is one of the few gas-insulated switchgears equipped with a Static Var Compensator power substation and expected to benefit about 250,000 residents within the catchment area.

It will help stabilise voltages and improve the quality and reliability of power supplied to the Awutu Senya East Municipality in the Central Region of Ghana.

It will also reduce technical losses in the power transmission and distribution system, contributing to the financial viability of the Electricity Company of Ghana (ECG) and the Ghana Grid Company (GRIDCo) in the long term.

The Kasoa BSP will be managed by the Electricity Company of Ghana and the Ghana Grid Company. It was completed in two and half years and within budget.

$64.72m Pokuase Bulk Supply Point (BSP) Substation

The Pokuase BSP, with a total capacity of 580MVA, is the largest BSP in Ghana.

Constructed under the existing 330kV Aboadze-Volta-Lomé Transmission line, the BSP is the first 330kV BSP in the capital and the most technologically advanced substation in Ghana.

A 33kV sub-transmission lines to evacuate power from the Pokuase BSP into the electric distribution network involves erecting new sets of Quadruple Circuit steel lattice towers to move power from the Pokuase BSP to ECG’s primary substations at Ofankor, Kwabenya and Nsawam.

The two contracts are worth a total of $64.72 million and are part of the electricity infrastructure being built by the Millennium Development Authority (MiDA) under the Ghana Power Compact, with funds provided by the United States Government through its Agency, the Millennium Challenge Corporation (MCC).

$15.8m Meter Management System

A Meter Management System (MMS) has installed been for the Electricity Company of Ghana (ECG).

The cost of the system is $15.8 million ($15,892,800), with MiDA contributing an amount of $11,189,901.

The MMS is designed to enable the integration of ECG’s smart pre-paid

metering platforms and enhance customer experience.

The system comprises a number of metering softwares, 17 servers, 40 point-of-sale devices, UPSs, laptops and printers.

The state-of-the-art MMS has full redundancy, involving a back-up that will enable the system to run uninterruptedly.

It has a primary site and a disaster recovery site, with an online real time automatic back-up capability.

The days when customers could not buy pre-paid credit because a pre-paid metering server has failed will soon be behind ECG.

The system contributes significantly to improving ECG’s revenue mobilisation efforts and will give customers greater flexibility in paying for electricity, as it will enable customers to buy any amount of pre-paid credit wherever they may be in Ghana.

$1.8m Air Conditioner and Refrigeration Test Laboratory

The MCC Ghana Power Compact also established the Air Conditioner and Refrigerator Test Laboratory at the Ghana Standards Authority.

The first of its kind in West Africa, the laboratory will help enforce standards to eliminate the importation of inefficient appliances that waste energy.

As part of the compact, 20 regulations for energy efficiency standards and labels have been updated to reflect new technology and await promulgation in Parliament.

MiDA and the Ghana Standards Authority (GSA) have invested $1.8 million ($1,886,981.14) in the construction of a new Air Conditioner and Refrigeration Test Laboratory for the Ghana Standards Authority (GSA) as part of the Energy Efficiency and Demand Side Management (EEDSM) Project of the Ghana Power Compact.

MiDA contributed $1.8 million ($1,841,841,981) while GSA provided $45,000 respectively.

Air conditioners and refrigeration appliances are high energy consuming appliances, therefore, the establishment of the test laboratory will support Ghana’s energy efficiency agenda.

The test laboratory, which is the first of its kind in Ghana and in the West Africa sub-region, has the capacity to test 96 air conditioners and 48 refrigeration appliances annually.

The facility will enable the Ghana Standards Authority to test and ensure that all air conditioners and refrigerators imported into Ghana meet the Minimum Energy Performance Standard (MEPS) set out in the Energy Commission’s Energy Efficiency Regulations.

The introduction of the facility is timely, as it will also support the work of the Energy Commission in enforcing the Import Certification Scheme, which demands that selected high-risk goods entering Ghana must be certified as meeting all obligatory standards.

The facility will also aid the effectiveness of the current Energy Efficiency Appliance Standards and Labelling regime being undertaken by the Energy Commission.

$8.5m Utility Geographic Information System

Under the compact, ECG has also developed two new information technology systems: the Geographic Information System (GIS) and Multimeter Management System (MMS) to modernise the utility and help reduce commercial losses.

It funded the installation of a Utility Geographic Information System (GIS) for ECG at a cost of $8.5 million

The project is part of the Modernising Utility Operations Activity, one of four project activities making up the ECG Financial and Operational Turnaround Project (EFOT).

The Utility GIS Project Activity comprises procurement and installation of system software, server hardware, field hardware, and services for data migration and field validation of assets (such as primary and secondary substations, power lines, poles, underground cables, transformers, switches and customer service wires)

The Utility GIS provides a digital platform and tools for ECG to plan, manage and efficiently operate its network to meet global utility management standards.

ECG’s customer experience will improve through enhanced power supply reliability, better supply quality and reduced service turnaround time.

The Utility GIS also provides ECG with the foundation for a more efficient revenue collection, losses reduction and outage reduction

The Utility GIS is available in 14 ECG districts across Accra East and West.

$11m substation for University of Ghana Medical Centre

The programme invested $11 million in the construction of a 52MVA Primary Substation and its associated Interconnecting Circuits (ICC) for the University of Ghana Medical Centre (UGMC).

The UGMC Primary Substation is one of many electric infrastructural assets which form part of the ECG Financial and Operational Turnaround (EFOT) Project of the Compact Programme.

The substation has a capacity of 52 mega volts amperes (MVA) and can supply all present and future power needs of the University of Ghana Medical Centre and the Noguchi Memorial Institute for Medical Research, and serve as an alternative source of supply to the University of Ghana, the Ghana Institute of Public Administration, the Ghana Standards Authority, and the surrounding communities.

Equipment within the substation comprise two 20/26MVA transformers, located outdoors and switching equipment housed in a basement-type control building.

The substation has been sized to provide for any future extension of the 33kV and 11kV switchgear.

The substation has been integrated into the existing ECG 33kV sub-transmission network through a total of 24 km of 33kV interconnecting circuits.

Power is evacuated to the UGMC and other load centres through 41.4 km of 11kV offloading circuits. Following its commissioning and energisation, the UGMC Primary Substation has been addressing the power supply challenges experienced by the UGMC and its sister institution, the Noguchi Memorial Institute for Medical Research.

These critical health institutions can now operate in an environment of more stable and reliable power. With the substation in close proximity to these institutions and with sufficient redundant capacity, the risk of equipment failure due to voltage fluctuations is significantly reduced.

Other benefits

The compact also supported the installation of more than 14,000 new energy-efficient streetlights with metered management systems, replacing old, inefficient lighting and setting a new standard for energy savings. Finally, the compact helped develop a curriculum for teaching energy efficiency in schools.

As a result of the compact, a partnership with three major technical universities will establish energy auditing centres to strengthen Ghana’s position as a leader in West Africa for energy efficiency.

As part of the MCC Ghana Power Compact, more than 600 female students in the fields of Science, Technology, Engineering and Math (STEM) participated in mentoring and training for professional growth and development.

Three hundred of these students found internship positions at leading energy sector institutions.

These internships have played a crucial role in helping employers embrace a more inclusive workforce and sustain the effort to provide more opportunities for women to thrive in occupations in the power sector typically dominated by men.

The Electricity Company of Ghana (ECG) has since adopted a gender policy, action plan, and new targets for greater female employee recruitment and promotion.

ECG will also partner with USAID’s Engendering Utilities Programme to continue making progress on creating a more inclusive, diverse energy sector workforce.

- Church of Jesus Christ, Ga Mantse Foundation renovate Adabraka School - 27 June 2024

- Manufacturers, Trade Minister tussle over proposed cement price regulation - 26 June 2024

- Work begins on Nima-Paloma drains - 26 June 2024