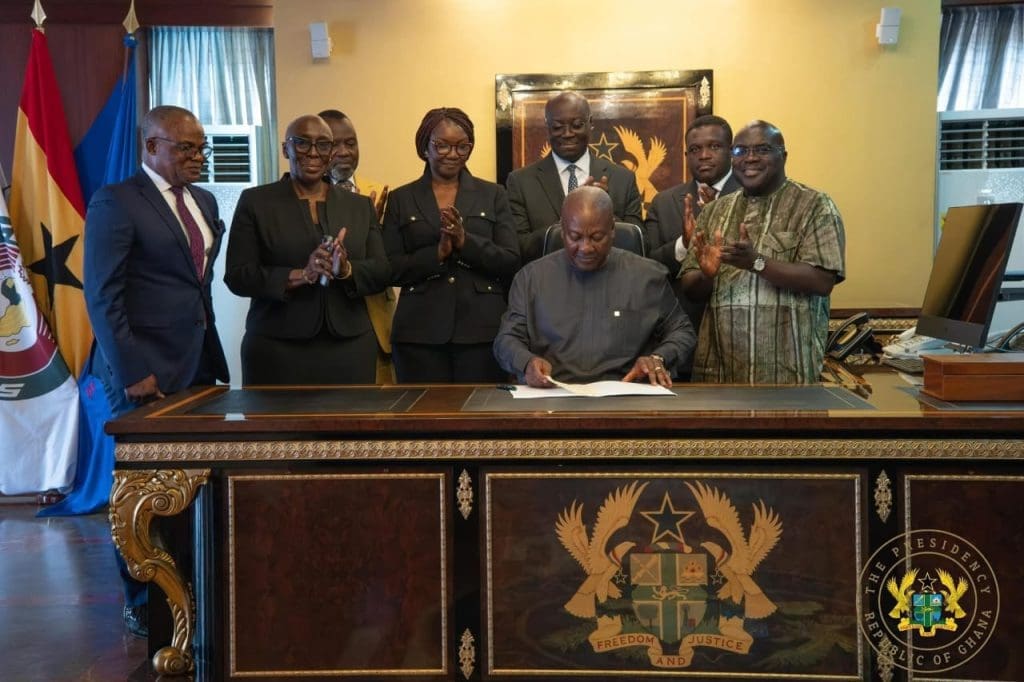

President John Mahama has assented to the COVID-19 Health Recovery Levy Repeal Act 2025 at his office at the Presidency in Accra.

The repeal Act was submitted to the President by the Clerk of Parliament, Ebenezer Djietror. President Mahama, after signing it presented it back to the Clerk of Parliament.

The Chief of Staff, Julius Debrah, Minister of Finance, Dr Cassiel Ato Forson, Attorney General and Minister of Justice, Dr Dominic Ayine, President’s Legal Advisor, Marietta Brew and Special Aide to the President, Joyce Bawa Mogtari, flanked the President when he signed the repeal act.

President Mahama said the repeal is the fulfilment of his campaign promise to scrap the tax, describing it as difficult to comprehend.

The Minister of Finance, Dr Cassiel Ato Forson, presenting the 2026 budget statement and economic policy of the government, announced that the COVID-19 Health Recovery Levy — commonly called the COVID-19 levy has been abolished.

The abolishment is part of a sweeping tax reform under the Value Added Tax Act.

The levy had been introduced in March 2021 under the COVID‑19 Health Recovery Levy Act, 2021 (Act 1068), at a rate of 1% on supplies of goods/services and imports, to raise revenue to support Ghana’s COVID-19 response.

The levy was originally intended as a temporary measure to help finance pandemic-related health expenditures. The government argues that the emergency has passed and the fiscal architecture must now be normalised.

The reform comes under a broader review of Ghana’s VAT regime, aiming to simplify the tax structure, remove the cascading effects of multiple levies, and reduce compliance burdens on businesses and consumers.

The move has backing from the International Monetary Fund (IMF) and stakeholders, who see value in consolidating levies into one unified system and improving tax efficiency.

The levy had been introduced in March 2021 under the COVID‑19 Health Recovery Levy Act, 2021 (Act 1068), at a rate of 1% on supplies of goods/services and imports, to raise revenue to support Ghana’s COVID-19 response.

The levy was originally intended as a temporary measure to help finance pandemic-related health expenditures. The government argues that the emergency has passed and the fiscal architecture must now be normalised.#

The reform comes under a broader review of Ghana’s VAT regime, aiming to simplify the tax structure, remove the cascading effects of multiple levies, and reduce compliance burdens on businesses and consumers.

The move has backing from the International Monetary Fund (IMF) and stakeholders, who see value in consolidating levies into one unified system and improving tax efficiency.