The Ministry of Finance (MoF) and the Bank of Ghana (BoG) have constituted a five-member Consultative Committee to lead extensive stakeholder engagements across key segments of the financial sector for input on government’s negotiations with the International Monetary Fund (IMF).

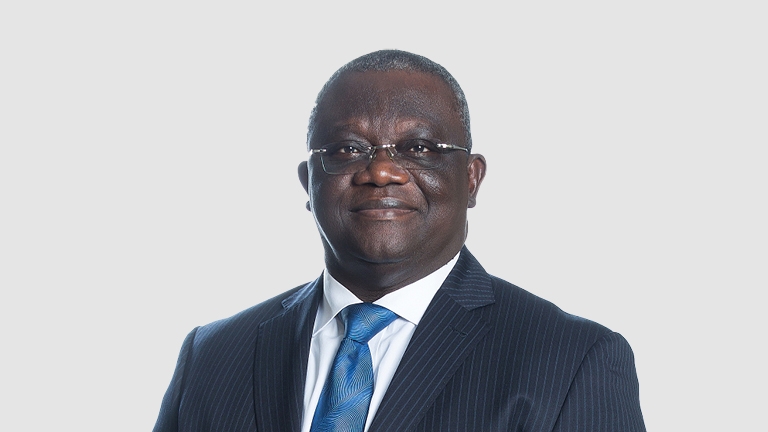

The Committee, made up of prominent financial services professionals, and chaired by Mr. Albert Essien, has other members as Mr. Simon Dornoo as Vice Chair, Mr. Alex Asiedu, Ms. Mabel Nyarkoa Porbley, and Mr. Peter Enti.

A statement from the MoF noted that the Committee will be consultative and among other things lead discussions with the financial services industry and other stakeholders to provide industry-wide input and transmit industry concerns on debt management strategy to the MoF and BoG.

The expectation, it said was to ensure orderliness and confidence in the Government’s ongoing negotiations with the IMF.

A similar engagement, the statement said will be undertaken with external bondholders.

“The stability of the domestic financial ecosystem is critical to a successful IMF-supported economic programme and government will take all necessary steps to protect the sector as we have done in the past.

“We need the support and trust of all Ghanaians to ensure that a historic arrangement is reached with the IMF. We are confident that such engagement and collaboration will enable us to recover very quickly and strongly from our current macroeconomic challenges,” it said.

Mr. Essien is a seasoned financial specialist with 30 years of experience in the banking sector. He is the former Chief Executive Officer of Ecobank Group.

He served on several boards, including the Development Finance Institute (Fin Dev), Canada, Old Mutual – South Africa, LMI Holdings as well as Jumo Africa. He is also the Board Chairman of Ghana Amalgamated Trust.

Mr Essien holds a Bachelor of Arts Degree in Economics from the University of Ghana, Legon and a fellow of the Chartered Institute of Bankers, Ghana.

Mr. Simon Dornoo is a seasoned financial specialist with over 30 years of experience in banking and finance.

He was the Managing Director of GCB Bank Plc from 2010 to 2016 and a Past President of the Ghana Association of Bankers. He worked with Barclays Bank Ghana Limited and Barclays Plc, United Kingdom. He also worked at Cal Bank.

Mr. Dornoo holds an MBA in Finance from Manchester University, UK, and a member of the Institute of Chartered Accountants, Ghana. He is also a member of the Ghana Association of Restructuring and Insolvency.

Mr. Alex Asiedu is an experienced Capital Market Expert and currently heads Standard Bank’s Africa Regions investment portfolio (excluding South Africa).

Prior to this role, he was the Managing Director of Stanlib Ghana Limited (now SIMS). He holds a Bachelor’s Degree in Economics from the University of Ghana and a Master’s Degree in Economics (Finance specialization) from Queen’s University, Canada.

He is a Yale World Fellow and a member of the CFA institute.

Ms. Mabel Nyarkoa Porbley is a seasoned insurance expert and a Managing Director of Sanlam General Insurance Ghana Limited, a subsidiary of Sanlam Group.

Prior to this, she was the Managing Director for NSIA Insurance Ghana. Ms. Porbley holds a diploma in Education and a BA degree in Management Studies from the University of Cape Coast.

She has an Executive Masters in Business Administration from GIMPA and is a chartered insurer from the CII UK.

Mr. Peter Enti is a seasoned expert in advisory services, including Pensions with over 13 years of experience.

He is currently a partner at Nubuke Business Investment Advisory.

He holds a Bachelor of Arts Degree in Economics and Statistics from University of Ghana, a Master’s degree in Accounting and Finance from London School of Economics, and a member of Chartered Institute of Management Accountants.

- Motorcycles killed 931 out of 2,276 road crash deaths in 2023 - 19 April 2024

- Friday April 19 2024 Newspaper Headlines - 19 April 2024

- Thursday April 18 2024 Newspaper Headlines - 18 April 2024