Ghana’s total public debt has declined by GH¢113.7 billion in just six months, signalling one of the most significant fiscal turnarounds in the country’s recent history.

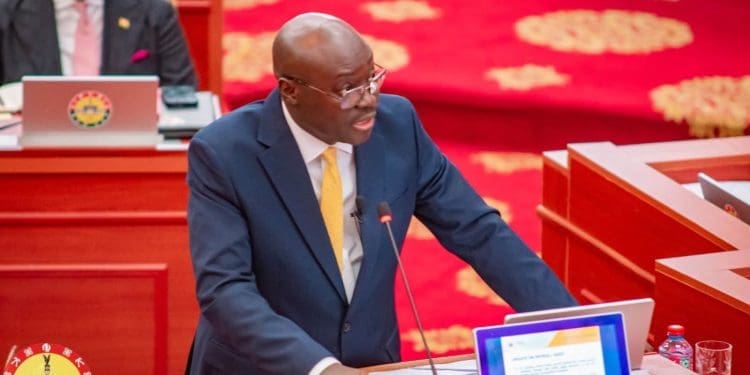

Finance Minister Dr. Cassiel Ato Forson announced the development on Wednesday during the presentation of the 2025 Mid-Year Budget Review in Parliament, attributing the reduction to a combination of prudent fiscal discipline, successful debt restructuring, and the appreciation of the Ghanaian cedi.

According to Dr. Forson, the country’s total public debt stock dropped from GH¢726.7 billion at the end of December 2024 to GH¢613 billion by the end of June 2025.

This marked a rare occurrence of what he called a “negative 15.6% rate of debt accumulation”, the first time such a reversal has been recorded in Ghana’s fiscal history.

Debt Exchange Programme driving gains

The significant drop in the debt stock is largely the result of Ghana’s Domestic and External Debt Exchange Programmes, which have been critical pillars of the country’s broader economic recovery strategy under the ongoing three-year International Monetary Fund (IMF) support programme.

The re-profiling of debt instruments, coupled with voluntary participation by domestic bondholders and external creditors, had eased the government’s debt servicing obligations and created fiscal space.

Under the debt restructuring programme launched in late 2022 and expanded through 2024, Ghana renegotiated key maturities and interest payments with both domestic and international creditors.

This led to a significant reduction in near-term financing pressures and improved liquidity for public investment.

The programme has not only helped slow the pace of debt accumulation but also enhanced investor confidence, as reflected in improved demand for medium-term government securities and stabilising sovereign bond yields.

Debt-to-GDP ratio sees historic decline

One of the clearest indicators of fiscal improvement is the dramatic fall in the debt-to-GDP ratio, which declined from 61.8% in December 2024 to 43.8% by June 2025 — an 18-percentage-point improvement.

Dr. Forson described this development as “unprecedented” and a sign of enhanced macroeconomic management, particularly under the IMF-backed reforms.

The Minister also disclosed that the composition of the country’s public debt had shifted in a more favourable direction.

The share of external debt fell from 57.4% to 49%, helping to reduce Ghana’s exposure to exchange rate shocks and global market volatility.

This change reflects not only lower external borrowing but also the strengthening of the cedi, which appreciated significantly in the first half of the year.

Commitment to fiscal discipline and reforms

While touting the gains, Dr. Forson assured Parliament of the government’s continued focus on responsible financial management.

He pointed to enhanced domestic revenue mobilisation, expenditure control, and procurement reforms as part of the government’s toolkit for ensuring long-term fiscal sustainability.

The Ministry of Finance, he said, is implementing tighter monitoring and reporting mechanisms to plug leakages in public spending and enforce value-for-money principles in procurement.

These measures, he argued, are essential to maintaining the current momentum and avoiding a return to unsustainable debt levels.

He also acknowledged that while macroeconomic indicators have improved, public confidence would ultimately depend on how these gains impact the real economy — particularly households, small businesses, and job creation.

Ratings, growth, and stability

Dr. Forson concluded by expressing optimism about Ghana’s credit outlook, stating that the government remains focused on improving its sovereign credit ratings, with the immediate target being an upgrade from the current B-minus rating assigned by Fitch.

He reiterated that the economic recovery remains fragile but is on the right track. “We must stay the course. We must continue to protect the gains we’ve made and focus on translating them into better living conditions for our people,” he said.

With the IMF programme now entering a critical phase and revenue-enhancing measures expected to kick in more fully in the second half of the year, the Finance Minister’s message was clear: Ghana’s debt trajectory has shifted, and the country is firmly on the path to restoring long-term economic stability.