The Bank of Ghana (BoG) has charged the media to play a decisive role in anchoring Ghana’s economic reset by embracing evidence-based, fair and responsible scrutiny of the Central Bank’s work and the broader economy.

Journalists have been urged to ask tough questions, examine outcomes and hold institutions to account, while carefully distinguishing signal from noise and short-term volatility from long-term economic direction.

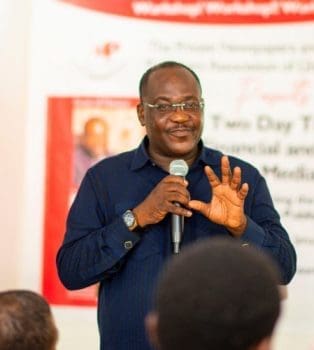

The call was made by the Governor of the Bank of Ghana, Dr. Johnson Pandit Asiama, in a speech delivered on his behalf by Dr. Francis Yao Kumah, Advisor to the Governor, at a training workshop organised for members of the Private Newspapers and Online News Publishers Association of Ghana (PRINPAG).

The workshop was held under the theme “Resetting the Economy: The Role of Journalists, News Publishers and Media Owners.”

According to the Governor, a healthy, independent and informed media ecosystem is indispensable to macroeconomic stability, particularly as Ghana transitions from crisis management to consolidation and long-term reform.

While scrutiny of the Central Bank and economic managers is both legitimate and necessary, he stressed that such scrutiny must be grounded in facts, context and a sound understanding of policy trade-offs.

“Ask tough questions, examine outcomes, but also ensure that you differentiate signal from noise, and short-term volatility from long-term direction,” Dr. Asiama said, noting that economic reporting significantly influences public confidence, market expectations and behaviour.

He urged journalists and publishers to support a rules-based approach in financial markets and payment systems, highlight good governance and consumer protection, and celebrate innovation that operates within clear regulatory guardrails.

This balanced approach, he said, helps align incentives across the financial system and ensures that innovation strengthens, rather than undermines, stability.

The engagement with PRINPAG marked the beginning of a deeper partnership between the Central Bank and the media.

Dr. Asiama said the Bank intends to strengthen collaboration with journalists, editors, publishers and media owners, recognising their role as the bridge between complex policy decisions and public understanding.

As part of this partnership, the Bank of Ghana announced plans to scale up specialised training programmes for journalists and editors covering monetary policy, foreign exchange market operations, payments oversight and financial stability.

The training will combine practical case studies, data interpretation and ethical guidance on reporting market-sensitive information, with the aim of improving accuracy, depth and professionalism in economic journalism.

The Central Bank will also establish a regular Editors’ and Producers’ Forum to engage newsroom leaders on upcoming data releases, policy cycles and emerging economic risks.

The forum is expected to provide critical context to editors, producers and presenters, enabling them to guide coverage responsibly and avoid misinterpretation of sensitive economic signals.

To further encourage high-quality reporting, the Bank announced the introduction of an annual Governor’s “Economic and Financial Story of the Year” Award.

The award will recognise journalists whose work demonstrates accuracy, depth of analysis, originality, clarity of explanation and public impact.

The winning journalist will be sponsored to attend the IMF and World Bank Annual Meetings.

Beyond formal programmes and awards, Dr. Asiama said the Bank’s Communications team will maintain open lines of engagement with newsrooms through timely clarifications, background briefings and access to authoritative data and subject-matter experts.

The goal, he explained, is to ensure that reporting on the Bank of Ghana is well sourced, accurate and confidently delivered.

“These initiatives reflect a simple conviction: when the media succeeds, the public understands; and when the public understands, the economy functions better,” he said.

Placing the media’s role within the broader economic reset, the Governor noted that Ghana has made significant gains over the past year, including declining inflation, improved order in the foreign exchange market and stronger external buffers.

However, he cautioned that stability is not the destination but the foundation for lasting reform.

Resetting the economy, he explained, also requires resetting expectations, institutions and behaviours — including behaviours within the information ecosystem.

In this regard, he described journalists, editors, publishers and media owners as indispensable actors.

Monetary and financial policies are often technical and sometimes counterintuitive, with effects that are not always immediate.

How they are reported, Dr. Asiama said, can either stabilise expectations or amplify uncertainty.

He therefore urged the media to deepen economic literacy, contextualise data, resist rumours and incomplete reporting, and strengthen internal verification processes, especially on sensitive issues such as inflation, interest rates and foreign exchange markets.

Constructive accountability, he added, remains essential, but it must be exercised in a manner that strengthens trust, supports reform and contributes to long-term stability.

“Resetting the economy is not the work of one institution alone,” the Governor said.

“You stand at the intersection of policy and public understanding. Together, we must reset expectations, reinforce institutions and reshape behaviours so that the gains of stability become the habits of a confident, prosperous economy.”

As part of the programme, the President of the Private Newspapers and Online Publishers Association of Ghana (PRINPAG), Mr. David Sitsopé Tamakloe, officially opened a national capacity-building workshop on economic and financial reporting, organised in partnership with the Bank of Ghana.

The two-day workshop, which commenced on February 24, 2026, brought together 45 participants, comprising 44 media professionals and one media consultant, drawn from PRINPAG member institutions across the country.

The training is aimed at strengthening the capacity of journalists to report accurately, responsibly and confidently on economic and financial issues.

Mr. Tamakloe expressed appreciation to the Bank of Ghana for its foresight, partnership and sponsorship, describing the initiative as a significant step towards deepening collaboration between the media and the nation’s central bank.

He underscored the growing influence of the media in shaping public confidence and market expectations, particularly in an era of heightened economic sensitivity and rapid financial innovation.