Ghana’s Black Volta Gold Mine, one of the country’s most promising mining concessions, has been revealed to hold proven resources and reserves valued at over $13.86 billion, based on current gold market prices.

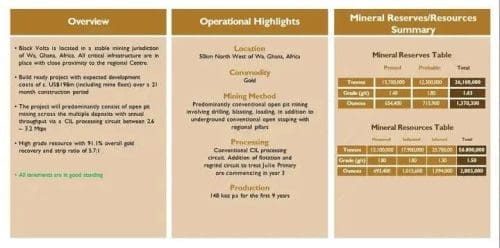

According to the data shared by James Wellbank, the Black Volta Gold Mine holds a total of 4.2 million ounces in proven resources and reserves.

This includes 2.8 million ounces classified as gold in resources and 1.4 million ounces categorised as reserves.

Using the prevailing gold price of $3,300 per ounce, the value of the 2.8 million ounces of resources amounts to $9.24 billion, while the 1.4 million ounces in reserves are worth $4.62 billion.

Combined, the total estimated value stands at $13.86 billion.

Currently, Azumah Resources Ghana Limited is embroiled in a bitter feud with Engineers and Planners Company Limited over the ownership of the gold mine.

Wellbank, Managing Partner at Ibaera Capital—the private equity fund backing Azumah Resources Ghana Limited, gave out the gold in resources and reserves figures during a presentation at the Africa Down Under conference held in Perth, Western Australia, from August 31 to September 2, 2022.

With the global price of gold currently at an average of $3,300 per ounce, the figures provided have reignited national and investor interest in the Upper West Region-based concession.

They also come at a time when the Ghanaian government is seeking to resolve disputes surrounding the site to fully unlock its economic potential.

Wellbank also highlighted that over 100 kilometres of gold anomalism had been identified across the concession, pointing to even greater mineral potential beyond the current estimates.

He said ongoing and future exploration efforts were expected to add further to the resource base.

Strong production and economic fundamentals

The mine is projected to produce more than 148,000 ounces of gold per year at an average grade of 1.9 grams per tonne over an initial life of 11 years.

Capital expenditure for the full development of the mine has been estimated at $196 million. According to Wellbank, the post-tax Net Present Value (NPV) of the project stands at $370 million, with an Internal Rate of Return (IRR) of 44 percent.

He further indicated that production costs are expected to hover around $905 per ounce, making the project highly profitable under current market conditions. Financial projections show an annual Earnings Before Interest, Taxes, Depreciation, and Amortisation (EDITDA) of $122 million for the first nine years of operation and a total pre-tax cash flow of $886 million over the life cycle of the mine.

Wellbank noted that the project’s economics are strong and present a compelling case for investment, both in terms of profitability and long-term sustainability.

Jobs, infrastructure, and national benefits

The Black Volta Gold Mine project is also poised to deliver major socio-economic benefits for Ghana.

Azumah Resources has already invested over $100 million in various development activities, including exploration, technical studies, infrastructure, and community engagement.

So far, more than 1,500 Ghanaians have been directly engaged through these activities.

Once operational, the project is expected to generate an additional 1,000 jobs, including 420 positions during the main production phase.

Wellbank stated that the mine is “ready for construction,” with critical infrastructure such as an airstrip, roads, power supply, and water systems already in place.

Over $1 billion benefits to Ghana

He added that at a production cost of $905 per ounce, the benefit to Ghana is projected to exceed $1 billion through taxes, royalties, job creation, and local development contributions.

Community development

Azumah Resources has also committed to improving the livelihoods of communities surrounding the Black Volta concession.

Wellbank said the company had already undertaken several development projects, including in education, water access, and basic infrastructure, to support local populations.

He reiterated that responsible and sustainable mining was at the heart of the company’s approach and that community trust and cooperation were essential for long-term success.

Why Ghana

Explaining why Ibaera chose to invest in Azumah Resources in Ghana, Wellbank cited several key factors, including the country’s status as Africa’s largest gold producer and the presence of major global mining companies already operating in the country.

He further pointed to Ghana’s relative political stability, low terrorism risk, and proven regulatory framework, which he described as conducive to responsible investment.

He also highlighted that over 50% of Azumah Resources’ energy is sourced from renewable resources and added that working within an English law jurisdiction made the legal environment predictable and comfortable for international investors.