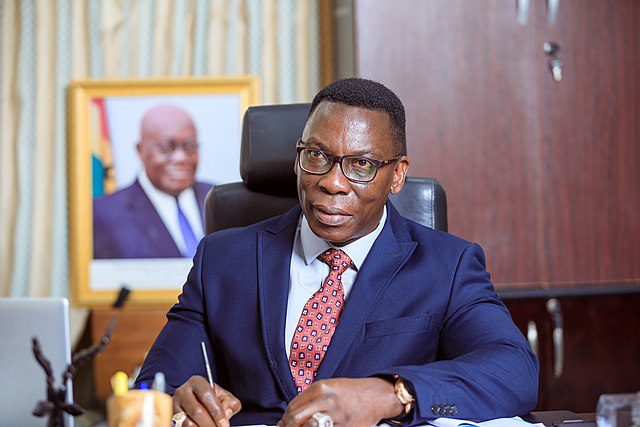

Commissioner of Insurance, Professor Justice Yaw Ofori has said under insurance and over insurance which refers to insuring an asset far and above the actual value of the asset is waste of money.

Amount exceeding loss will not be compensated

According to him, in the event of damage, the insured will be compensated the amount equal to the actual loss and not the amount exceeding the loss.

Therefore, he said policyholders should pay premiums that cover the actual value of assets.

It is a condition of the insurance that the sum insured represents the full true total value of the property stored at all times.

Prof. Ofori gave the advice at workshop for selected top media practitioners on insurance fraud.

Types of fraud

Insurance fraud is a type of fraud perpetrated against or by a company or agent for the purpose of financial gain.

It may fall into different categories, from individuals committing fraud against consumers to individuals committing fraud against companies in the industry.

Economic reconstruction and growth

Insurance is not only an important risk mitigation tool but can also play a critical role in the economic reconstruction and growth of a country.

While the industry continues to grow, it continues to be plagued by frauds.

Impact on individuals, financial sector

Insurance fraud affects the financial sector through loss of funds and worsens the economic situation of individuals and consequently, the country.

Multiple policies on assets waste of money

Prof. Ofori pointed out that apart from life insurance, paying premiums more than the value of an asset or taking multiple policies from different companies for the same asset expecting to make profit is an exercise in futility.

Coverage of the loss

He stated that insurance is done only for the coverage of the loss and therefore, the insured should not make any profit from the insurance contract.

He explained that the insured should be compensated with an amount equal to the actual loss and not the amount exceeding the loss.

Indemnity principle

The Commissioner noted that the purpose of the indemnity principle is to set back the insured at the same financial position as he or she was before the loss occurred.

As a result, he said if an insured takes multiple policies for the same asset, the various companies will contribute to pay the actual value and not pay more than that.

In this case, the insured who has paid multiple premiums for same asset with the view of making profit will be at a loss.

He stated that the principle of indemnity is observed strictly for property insurance and not applicable for the life insurance contract.

Similarly, Prof Ofori cautioned against insuring less than the value of the property referred to as under insurance .

In case of under insurance, he said the company shall indemnify only that portion of loss, which corresponds to the ratio of the amount insured and not the actual value of the property.

He explained that under insurance is assessed by comparing the amount insured with the restoration value of the object of insurance upon calculation of the indemnity according to the restoration value, and with the current value upon calculation of the indemnity according to the current value.

- Friday, May 9, 2025 Newspaper Headlines - 9 May 2025

- Adangabey brightens rural kids’ future from his wheelchair - 9 May 2025

- Stanbic donates ICT equipment to UHAS for digital learning - 9 May 2025