Mr. Seth Terkper, former Finance Minister, has cautioned the government against borrowing to fulfill populist agendas, warning that such actions could leave the country overwhelmed with debt. Instead, he called for prudent borrowing, with a focus on ensuring manageable loan terms, investing borrowed funds for profitable returns, and building strong financial buffers for timely repayment.

Prudent Borrowing and Debt Management

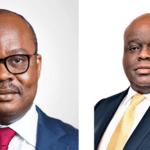

Speaking during a virtual press briefing on Tuesday, October 15, Mr. Terkper emphasized the need for careful borrowing practices in light of Ghana’s recent Staff-Level Agreement with the International Monetary Fund (IMF) on the third review of its ongoing loan-support program.

He noted that borrowing was often necessary, especially for major infrastructure projects that could consume a significant portion of the national budget, but excessive borrowing must be avoided to prevent debt accumulation.

“We have to look at debt in terms of borrowing to fulfill a populist agenda, which does not generate as much revenue as possible,” said Mr. Terkper, who now serves as Executive Director of the Public Financial Management (PFM) Tax Africa Network.

Concerns over populist agendas

Mr. Terkper expressed concern that borrowing to finance populist agendas—policies aimed at short-term economic benefits, especially around election periods—can be unsustainable.

He warned that such practices often stimulate growth temporarily but leave the country vulnerable to rising debt in the long term.

The need for domestic revenue mobilization

Mr. Terkper emphasized the importance of increasing domestic revenue through reforms that lower taxes and eliminate “nuisance” taxes, which he said would encourage greater compliance from individuals and businesses.

He stressed that Ghana’s current revenue levels are insufficient to finance major infrastructure projects, such as roads, railways, and airports, which are essential for delivering quality public services.

Managing expenditure and taming debt

Mr. Terkper called on the government to control expenditures, accelerate debt repayment, and build buffers to prevent future economic challenges.

He urged a disciplined approach to managing arrears, deficits, and living within the country’s means.

“When we get additional revenues, as commodity prices rise, we should put something aside,” he advised.

Learning from past experiences

Drawing on Ghana’s past experiences with debt, including the Highly Indebted Poor Countries (HIPC) program, debt forgiveness, and debt suspension, Mr. Terkper stressed the importance of creating long-term financial structures to avoid falling back into unsustainable debt levels.

“Government should treat debt and buffers like households do,” he remarked, emphasizing that sound debt management is crucial for the country’s financial stability.

- Painter accused of stealing BoG cables granted GH₵1m bail - 2 April 2025

- Police amend charges and facts in Ahmed Suale murder case - 2 April 2025

- Inflation declines slightly to 22.4% in March - 2 April 2025