The Minority in Parliament has expressed alarm over the responses provided by Finance Minister-designate Dr. Cassiel Ato Forson during his vetting on Monday, January 13. They argue that his evasive answers raise fears of harsher tax measures being introduced to address revenue shortfalls.

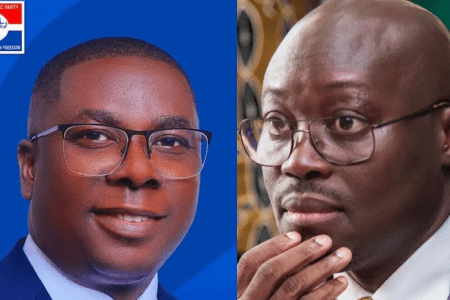

Speaking at a press conference, Dr. Gideon Boako, Member of Parliament for Tano North, criticized Dr. Forson’s lack of clarity on his plans to manage revenue gaps without imposing additional financial burdens on Ghanaians.

“The Minister-designate’s unconvincing responses regarding how he intends to make up for the revenue shortfalls leave us with no choice but to think that he will scrap these taxes but introduce new ones, perhaps more draconian than those he would scrap,” Dr. Boako remarked.

He emphasized that replacing existing taxes with potentially more punitive ones would essentially mean “giving with one hand and taking with the other.”

Integrity questions raised

The Minority also took issue with perceived inconsistencies in Dr. Forson’s responses during the vetting process, particularly regarding fiscal data. Dr. Forson was accused of using incorrect figures to defend his claims about Ghana’s fiscal deficit in 2016.

He had initially stated the deficit was 6.1%, which he described as “charitable,” but this conflicted with data from the International Monetary Fund (IMF) that pegged the deficit at 6.3%.

Dr. Boako criticized the discrepancy, stating, “Can a Minister boldly claim he was charitable in presenting incorrect figures? Interesting.”

Calls for transparency and accountability

The Minority’s concerns highlight their demand for transparency and accuracy in addressing Ghana’s economic challenges.

They urged the Finance Minister-designate to provide a detailed and transparent roadmap for managing revenue shortfalls without unduly burdening citizens.

As the vetting process continues, the Minority’s criticisms underscore the need for robust parliamentary oversight to ensure that appointees are held accountable for their plans and decisions.

- Military service commanders sworn into Armed Forces Council - 25 April 2025

- Finance Minister unveils plan to tackle 2024 payables - 25 April 2025

- 2 potential flagbearers donate GH¢3m and GH¢1m to NPP - 25 April 2025