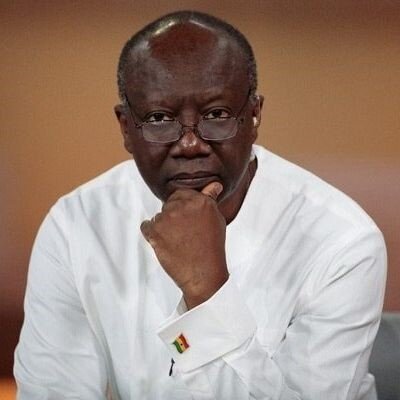

Finance Minister Ken Ofori-Atta is hopeful that the Executive Board of the International Monetary Fund (IMF) will approve Ghana’s $3 billion balance of payment support loan by the end of the second quarter of 2023.

Eurobond, official creditors agreements expected soon

According to him, a memorandum of understanding with official creditors and an agreement in principle on Eurobond restructuring is expected by May.

IMF-World Bank Spring Meeting

He made these disclosures during a virtual briefing at the ongoing IMF-World Bank Spring Meeting taking place in Washington DC in the United States of America.

$54bn total public debt stock

Ghana’s total public debt stock stands at $54 billion, out of which $28 billion is owed to foreign creditors.

Restructuring of public debt

Restructuring of public debt has to be completed in order for the IMF board to approve the staff-level support package.

GH₵82.9bn of domestic debt restructured

Approximately 85% of bondholders participated in the Domestic Debt Exchange Programme (DDEP) yielding GH₵82.9 billion (GH₵82,994,510,128).

DDEP to save GH₵38bn debt servicing

Ofori-Atta revealed that the DDEP is expected to yield debt service savings of GH₵38 billion the equivalent of $3.3 billion in 2023.

GH₵52.6bn debt servicing cost for 2023

Without debt restructuring, Ghana debt serving cost for 2023 was estimated at GH₵52.6 billion.

$20bn of external debt eligible for restructuring

He said $20 billion of the external debt was eligible for restructuring, 66% of which is under the form of external debt stock.

Ghana owes China $1.9bn

Out of Ghana’s $8.5 billion bilateral loans, about $1.9 billion is owed to China.

$5.4bn of bilateral debt to be restructured

The Finance Minister said $5.4 billion in official creditor debt will also be restructured

$1.5bn financial stability fund

He added that Ghana needs a $1.5 billion financial stability fund to ensure appropriate solvency and liquidity.

World Bank pledges $250m

Ofori-Atta disclosed that the World Bank has fortunately agreed to support this fund with $250 million.

Govt to commit $500m

According to the Finance Minister, government is considering committing about $500 million to the fund.

$2.6bn net foreign exchange from $9bn in January 2022

Speaking at the briefing Bank of Ghana (BoG) Governor Dr Ernest Addison announced that net foreign exchange reserves have dwindled from $9 billion of the end of January 28, 2022 to $2.6 billion currently.

$600m monthly demand

With a monthly demand of over $600 million of which oil importers also required $480 million, the reserves of the central bank would have been lower than the $2.6 billion if external debt servicing had not been suspended.

Inflation at 45% from 9.9% in January 2021

Inflation which was 9.9% in January 2021 accelerated sharply to a more than two-decade high of 54.1% in December 2022, but has since slowed, falling to 45% year-on-year in March

The government also aims to bring rampant inflation down to 8% in the medium term and is targeting real GDP growth of 5% in over the same period.

Factors sinking economies

Ballooning inflation, escalating borrowing costs and a strong dollar have made repaying loans and raising money significantly more expensive for dozens of developing nations, pushing several into default.

60% of low-income countries are in or near debt distress

Some 60% of low-income countries are in or near debt distress, but the Group of 20 (G20) common framework set up to help low income countries has failed to deliver quick debt relief.

$2.5-trillion external debt-service costs

Developing nations may need to find as much as $2.5-trillion over five years to meet external debt-service costs as interest rates rise and poorer countries struggle to refinance borrowings.

$55 billion repayment this year

Nations that are eligible for the Common Framework must repay about $55 billion of debt this year.

Double shock for low-income countries

Low-income countries are expected to suffer a double shock from higher borrowing costs and a decline in demand for their exports which could fuel poverty and hunger.

Capital outflows from many low-income countries

Many low-income countries are now facing mounting debt burdens due in part to the higher interest-rate environment, which is also leading to capital outflows from many of the countries most in need of investment.

- Inflation Rate falls marginally to 21.2%in April - 8 May 2025

- Kidnapped victims: Efforts underway to bring them home – CID boss - 8 May 2025

- Thursday, May 8, 2025 Newspaper Headlines - 8 May 2025