The public has been urged to engage the services of qualified insurance brokers to ensure they receive accurate information and are not shortchanged on insurance matters.

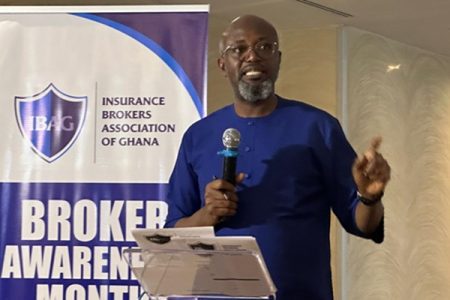

According to the President of the Insurance Brokers Association of Ghana (IBAG), Mr. Shaibu Ali, the services of a broker come at no additional cost to the premium charged for insurance policies.

He explained that policyholders already cover broker fees as part of the premium in a portion referred to as “acquisition cost,” which compensates brokers for their work.

This clarification was made during a recent interaction with selected media practitioners.

Insurance Brokers represent clients’ interests

Mr. Ali emphasized that insurance brokers act as independent professional intermediaries who represent the interests of their clients, ensuring that they purchase the right insurance products at the right premiums, with the best terms from reputable companies.

Brokers, he explained, assist clients in making informed decisions that are tailored to their unique needs.

Licensed brokers also provide crucial guidance and personalized services, helping clients choose the appropriate coverage for their circumstances.

This process includes ensuring that clients navigate the often complex claims process with ease, as brokers guide them through the necessary procedures and documentation.

Smoother claims process with brokers

One of the key advantages of using a broker, Mr. Ali noted, is the smoother claims process that clients experience compared to dealing directly with insurance companies.

“Clients can hold brokers accountable for everything related to their insurance policies,” he stated.

Brokers, with their deep knowledge of the market, ensure that policyholders are paying the right premium and buying from reliable insurance companies.

Mr. Ali warned that many people who purchase insurance policies from non-insurance institutions often face challenges, particularly when it comes to filing claims.

He noted that while selling insurance products can seem straightforward, the real issues arise when claims need to be made.

Beware of non-insurance institutions selling insurance

Mr. Ali expressed concern over the growing trend of financial institutions selling insurance products to consumers.

He explained that many clients are having negative experiences because they are dealing with bodies that are not professional insurance providers.

This, he said, has led to a significant portion of the negative publicity the insurance industry has received in recent times.

According to Mr. Ali, if a broker fails to renew a policy when it expires and a claim arises, the broker would be liable to pay through its professional indemnity cover, which is no less than GH₵500,000.

October awareness campaign

In light of the importance of brokers to the insuring public, IBAG has set aside the month of October to raise awareness about the role and relevance of brokers in the insurance industry.

IBAG, which was inaugurated on October 27, 1988, with just 15 licensed broker firms, now boasts a membership of 102 firms.

The association not only serves as a voice for insurance and reinsurance brokers, but also advocates for the rights of insurance consumers.

A key part of IBAG’s objectives is to spread knowledge of insurance and insurance broking to the public, ensuring that consumers are well informed.

Ensure adequate protection amid economic challenges

Given the current economic challenges, Mr. Ali stressed that it is crucial for both individuals and commercial entities to ensure they have all the necessary insurance policies in place to provide adequate protection in the event of an insured incident.

He urged the public to always buy insurance from qualified, licensed, and authorized insurance institutions to avoid future problems.

By collaborating with insurance professionals, the media can also play a role in clarifying complex topics, informing consumers of their rights, and improving the overall public understanding of insurance for financial security.

- Blewett: MTN CEO, a pilot, author, chartered accountant, marathon runner and many more - 3 April 2025

- MTN Ghana launches Y’ello Ladies Network - 3 April 2025

- GEMA unveils 5yr- strategic plan at 34th AGM - 3 April 2025