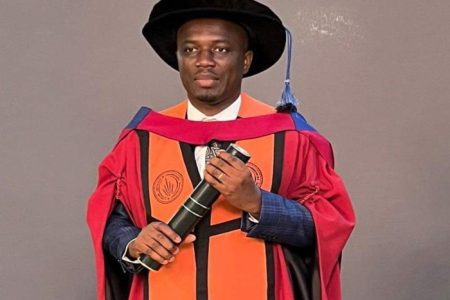

Development Economist Dr. Frank Bannor has endorsed Vice President Dr. Mahamudu Bawumia’s proposed tax reforms, describing them as essential for Ghana’s accelerated growth and development. Dr. Bannor, who also serves as the Head of Research at Danquah Institute, highlighted that the current tax regime in Ghana is overly complex, deterring citizens from fulfilling their tax obligations.

Dr. Bannor emphasized the benefits of a simplified tax system, referencing the positive example set by South Africa. “If citizens know they’re likely to reap benefits from filing their tax returns, they’ll gladly file their tax returns. South Africa has shown the way; go to Johannesburg and see how happy citizens become queuing to file their taxes,” he stated.

Dr. Bannor cited meetings with various labor organizations, including the Ghana Union of Traders Association (GUTA), the Ghana Pharmaceutical Association, and the Ghana Medical Association, which revealed widespread dissatisfaction with the current tax system. These groups find the system cumbersome, leading to disputes and conflicts with the Ghana Revenue Authority (GRA).

He further noted that business owners often face uncertainty regarding their tax liabilities, resulting in GRA officials sometimes demanding more taxes than owed.

This confusion can drive businesses to avoid paying taxes altogether.

In response to these challenges, Vice-President Bawumia has proposed a series of tax reforms, which he presented at a meeting with the Ghana Chamber of Commerce and subsequently outlined at the University for Professional Studies in February 2024.

Key measures in his proposal include introducing a simple, citizen- and business-friendly flat tax regime, implementing a flat tax on a percentage of income for individuals and SMEs, which constitute 98% of businesses in Ghana, with appropriate exemption thresholds to protect the poor, granting tax amnesty, conducting electronic and faceless audits by the GRA, eliminating taxes on digital payments, thereby abolishing the e-levy, Removing VAT on electricity if still applicable, abolishing the emissions tax, eliminating the betting tax, fully automating Tema Port, aligning duties and charges at Tema Port with those at Lome Port and setting a flat rate per container for spare parts import duties.

Dr. Bannor believes that these measures will significantly enhance Ghana’s economic stability and growth by simplifying the tax system and encouraging compliance. He praised the proposal for its potential to increase revenue, expand the tax base, and provide a fairer system for both individuals and businesses.

The Development Economist concluded by expressing his optimism about the future impact of these reforms, stating that they would bring in more revenues to the consolidated fund and encourage more people to participate in the tax system, ultimately benefiting the Ghanaian economy.

- Fighting cocaine with the cross - 18 April 2025

- Galamsey, Cocaine: of truths, errors and the priest - 18 April 2025

- Human trafficking: EOCO arrests 219 members of West African cartel - 18 April 2025