Ghana’s economic fortunes have long been tied to the ebb and flow of its currency- the Cedi. Over the past decade, the Real Effective Exchange Rate (REER) has traced a path of relative stability, followed by sudden turbulence—a journey that now demands urgent policy attention.

The calm before the storm

Between 2015 and 2019, Ghana’s REER hovered near equilibrium, supporting export competitiveness and a healthy external balance.

This period of stability fostered optimism among policymakers and exporters alike.

Yet, as the world reeled from the Covid pandemic, Ghana’s currency began to appreciate moderately, with the equilibrium rate remaining steady.

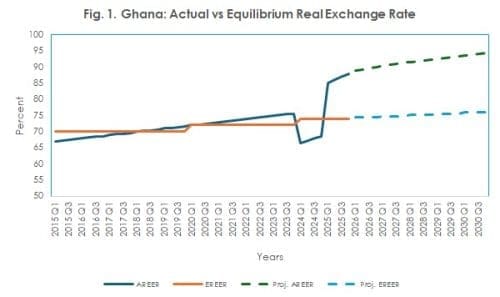

Source of Data: Author’s estimation based on IMF’s Behavioral Equilibrium Exchange Rate (BEER) model.

Determinants

GDP growth, interest rate differentials, commodity prices. Estimated equilibrium REER for Ghana tends to hover near 70–75 (2010=100) in recent years, suggesting mild undervaluation in 2024 and sharp overvaluation in 2025.

Historical and projected REER vs. equilibrium REER, 2015–2030

Fig. 1 visualises the REER’s journey, showing its close alignment with equilibrium until 2019, and the dramatic divergence projected from 2025 onwards.

The projections from 2025 are based on the assumption of unchanged policy.

Meaning the policy mix in 2025 does not change and it is maintained into the future.

The sharp appreciation in 2025, where actual REER leaps to 85–88 against an equilibrium of 74, marks a turning point—one that signals overvaluation and raises alarms about Ghana’s global competitiveness.

The chart shows that the sharp depreciation in 2023 into 2024 which led to undervaluation of the currency was not consistent with the fundamentals.

The drivers of that depreciation were at variance with the fundamentals—that is what should be expected in crisis periods.

And it would have been wrong to use hard earned FX reserves to fight such deviation from the long-term trend, despite the painful effects in the economy.

In the same way, the sharp appreciation in 2025 also is not consistent with the fundamentals.

And this time, it is creating very wide misalignment that could have lasting effects if not urgently corrected.

The risks of overvaluation

Why does this matter? An overvalued currency can erode export competitiveness, making Ghanaian goods more expensive abroad and increasing reliance on imports as imported goods become cheaper which will undermine the domestic economy.

The consequences ripple through the economy: widening current account deficits, pressure on foreign reserves, and inflationary surges.

If left unchecked, these trends threaten to dampen industrial growth and job creation, undermining Ghana’s long-term prospects (transformation and diversification objectives).

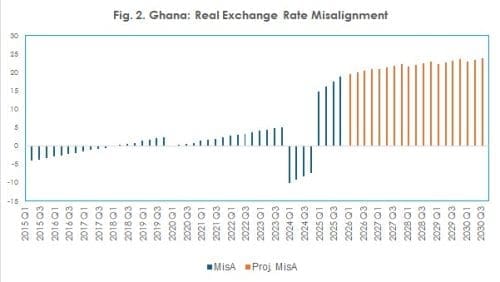

Source of Data: Author’s derivation from estimated model for the equilibrium real exchange rate.

REER misalignment (MisA), 2015–2030

Fig 2 illustrates the degree of REER misalignment over time. Positive values indicate overvaluation, negative values undervaluation.

For the period up till end of 2024, the degree of misalignment of the series appear stationary (integrated of order zero—no unit roots).

What this indicates in simple terms is that movement in real exchange rate is mean-reverting (moving close around its long-term trend).

In standard terms, one can say the real exchange rate in Ghana during that period was aligned to its fundamentals. Deviating from trend or equilibrium within ±5% is an indication of alignment with fundamentals.

Deviation within ±10% is an indication of “broad alignment” with fundamentals. Anything above ±10% is a clear case of misalignment, requiring urgent policy intervention.

Beyond 2024, the process is not stationary (sharp divergence from the long-term trend) and would require policy intervention to bring it back closer to the long-term trend.

As indicated earlier, projected misalignment beyond 2025 is based on the assumption of unchanged policies—maintaining existing policies in 2025.

Policy at the crossroads

How should Ghana respond? The answer lies in a coordinated, multi-pronged approach:

Flexible exchange rate management

The Bank of Ghana must intervene judiciously to prevent excessive appreciation, using sterilised interventions to maintain monetary policy credibility.

Current sharp deviation of the real exchange rate from its long term trend, which is not aligned with the fundamentals, could undermine monetary policy credibility and gains made so far.

Reserve accumulation

Building robust foreign reserve buffers (now that the “rains are not pouring”) will help cushion the economy against potential external shocks and currency volatility.

Export diversification

Over the medium to long term, diversification policies should be intensified, now that Ghana is in the “calm period,” by promoting non-traditional exports and value-added sectors—such as agro-processing and manufacturing—to reduce dependence on primary commodities and strengthen competitiveness.

Given that the long term is made up of an envelop of short-term dynamics, policies to be achieved over the medium to long term should be started now in the short term. “Think big, start small, but start now.”

Fiscal and monetary coordination

Fiscal policy must align with monetary objectives, with counter-cyclical measures deployed during periods of misalignment.

Structural reforms

Investment in infrastructure, technology, and skills development will boost productivity and lower transaction costs.

Total factor productivity in Ghana has been declining consistently; it has even intensified in the last two years.

This must be reversed if Ghana wants to build a resilient economy that can withstand shocks.

Monitoring and forecasting

The Bank of Ghana, it is believed, already has an in-house REER monitoring framework.

This should influence exchange rate policy.

What is unclear is how this monitoring framework has influenced the sharp and unsustainable appreciation of the currency and whether the consequences outlined above would be considered in exchange rate policy going forward.

Looking ahead

Ghana’s experience is a cautionary tale for emerging markets and developing economies (EMDEs).

Proactive, coordinated policy measures are essential to prevent sustained overvaluation and safeguard external competitiveness.

By aligning monetary, fiscal, and structural policies, Ghana can maintain macroeconomic stability and support long-term growth—even as global headwinds gather.

By Anane Agyei, PhD

Wait A moment Platform

January, 2026