The Social Security and National Insurance Trust (SSNIT) has announced a 10% upward adjustment in monthly pension benefits for the 261,920 pensioners on its payroll as of December 31, 2025.

The increase forms part of the Trust’s annual indexation exercise.

The 2026 indexation rate, set in consultation with the National Pensions Regulatory Authority (NPRA) and in line with Section 80 of the National Pensions Act, 2008 (Act 766), comprises a fixed 6% increase and a redistributive component of GH₵91.56 derived from the remaining 4%. This model is designed to provide additional support to pensioners earning the lowest benefits.

With the new rates, pensioners currently receiving the minimum pension of GH₵300 will now earn GH₵409.56 per month, representing a 36.52% rise driven by the redistribution mechanism. Individuals entering the Scheme in 2026 will receive a new minimum pension of GH₵400.

At the upper end, the highest-earning pensioner will see benefits increase from GH₵201,792.37 to GH₵213,991.47.

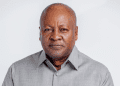

Announcing the adjustment in Accra, SSNIT Director-General Kwesi Afreh Biney explained that the redistribution approach is intended to cushion low-income pensioners and uphold the social solidarity principle underpinning the Scheme.

He noted that while the 2025 adjustment was 12%—implemented when inflation was 23.8%—the 2026 increase of 10% represents real growth, as inflation had declined to 5.4% by December 2025.

“The current indexation exceeds the recent inflation rate. This means all pensioners have effectively been shielded from inflationary pressures,” he said.

He reaffirmed SSNIT’s commitment to both pensioner welfare and long-term sustainability, emphasising that improvements in the Fund’s performance would continue to translate into better benefits.

Chief Actuary Evelyn Adjei stated that the 2026 rate was determined based on salary growth trends among active contributors, projected average inflation of 8 ± 2% for 2025, and an assessment of the Fund’s future financial outlook.

She noted that around 70% of pensioners would enjoy the full 10% increase, which adds approximately GH₵616.6 million to the Scheme’s expenditure for 2026.

SSNIT expects to pay out more than GH₵7 billion in benefits for the year, averaging over GH₵580 million monthly.

General Manager of Benefits, Frank Mobila, highlighted that the adjustment reinforces SSNIT’s commitment “to protecting the dignity and purchasing power of pensioners while ensuring the sustainability of the Scheme.”

As of the end of 2025, SSNIT’s active contributors stood at 2.1 million, two-thirds from the private sector and one-third from the public sector.