In an industry long dominated by multinational giants with decades of accumulated capital, technical capacity and geopolitical backing, Springfield Exploration and Production Limited (SEP) stands today as a remarkable outlier.

It is the first and only fully Ghanaian company to strike oil in Ghana’s offshore deepwater.

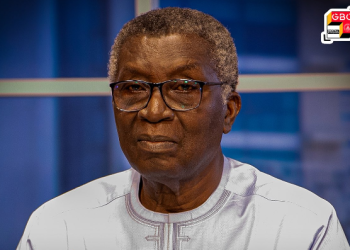

This achievement, led by Springfield’s Founder and Chief Executive Officer (CEO) Kevin Okyere, represents a seismic shift in perceptions about what indigenous participation in the upstream petroleum sector can look like.

It is a feat with profound implications—not just for the oil and gas industry, but for the broader question of Ghanaian ownership of the national economy.

The recent decision by the Government of Ghana to lead discussions that may result in fresh capital injection into Springfield—either through new partnerships or expanded GNPC-Explorco participation—has generated intense public debate.

But beneath the commentary lies a deeper story: a story of extraordinary resilience, a bold entrepreneurial gamble, and a pioneering Ghanaian vision that has already changed the narrative of who can lead exploration and production in a resource-rich African nation.

A trailblazing indigenous investment

When Springfield first expressed interest in the relinquished West Cape Three Points Block 2 (WCTP 2) in 2012, few believed a Ghanaian-owned entity could break through the technical, financial and institutional barriers that have historically shut out local participants from upstream operations.

Upstream petroleum development is notoriously capital-intensive. Drilling a single well can cost between $50 million and $100 million.

Seismic acquisition, appraisal and field development run into hundreds of millions.

It is an industry where even large international firms can falter.

Yet Okyere—only 32 years old at the time—insisted on competing.

His persistence paid off when Springfield was awarded the block after a complex, multi-year application process concluding in 2016, with parliamentary ratification of the Petroleum Agreement.

Ghana has four upstream operators: Tullow Ghana Limited, Eni Ghana E&P, Aker/Pecan Energies, and Springfield.

Among them, Springfield stands uniquely as the only indigenous operator.

This is not a symbolic victory—it is a historic breakthrough fueled by risk-taking, strategic investment and technical discipline.

A strategic bet: The $9.3m seismic gamble

One of Springfield’s most consequential decisions came in 2017 when the company contracted the world’s largest seismic vessel—the Ramform Titan owned by Petroleum Geo-Services (PGS)—to undertake comprehensive 3-D seismic acquisition over all 673 square kilometres of WCTP 2.

This operation cost $9.3 million ($9,317,000) and was not originally part of Springfield’s work programme.

It was a voluntary investment intended to refine subsurface understanding and de-risk the block.

The data obtained fundamentally transformed the asset’s value. It unlocked the pathway to drill Afina-1x, which would become one of Ghana’s most important discoveries since Jubilee and Sankofa.

Afina Discovery: 1.2 trillion cubic feet of gas

The Afina-1x well confirmed hydrocarbons in commercial quantities, comprising over 1.5 billion barrels of oil in place and an estimated 1.2 trillion cubic feet of gas

Projected output from the discovery—together with adjacent fields—indicates potential peak production of 80,000 stb/day of oil and 250 mmscf/day of gas.

These are transformational numbers for any operator, but they are especially remarkable for a first-time indigenous company.

What makes the Afina achievement even more extraordinary is that the discovery was made in Cenomanian and Turonian formations in deepwater—a level of geological and operational complexity that no indigenous African upstream company had previously conquered.

All operations were completed on schedule, within budget and with zero safety incidents.

The achievement affirmed Springfield’s place among competent global upstream operators.

Independent evaluations by respected petroleum consulting firms in the United States and the United Kingdom subsequently validated the reserves.

Resilience through legal and regulatory challenges

Springfield’s journey has not been without hurdles.

The legal dispute with Italian oil major ENI over the Sankofa field’s connectivity with Springfield’s Afina accumulation slowed progress.

Nonetheless, the Petroleum Commission directed Springfield to appraise Afina, and in just three months, Okyere mobilised resources, technical partners and service companies to conduct the appraisal campaign.

The results again proved positive. The discovery was confirmed as commercial, and communication between Afina and Sankofa was established, strengthening the case for unitization.

This was another testament to Springfield’s operational capability, agility and determination in the face of daunting opposition.

$280m investment

Perhaps the most overlooked element of the Springfield story is that over $280 million in seismic work, drilling, appraisal, regulatory compliance and operational activities was funded by Okyere and his partners—not foreign multinationals.

Hundreds of jobs were created directly and indirectly through the award of contracts and sub-contracts to local and international service providers.

This is what indigenous ownership looks like: a Ghanaian entrepreneur risking capital, vision, reputation and time to build something that creates opportunities for other Ghanaians.

As Okyere has consistently emphasised, “the assets must be produced for the benefit of Ghanaians and Africans.”

A nationally strategic step forward

Critics of the government’s decision to explore avenues for acquiring part of Springfield’s stake in WCTP 2 often overlook a critical reality: Springfield has already proved the resource base. The hydrocarbon reserves are not speculative—they are proven.

What Springfield needs now is fresh capital to move from discovery to full-field development.

The current government-led discussions—whether to bring in new partners or expand the participation of GNPC-Explorco—are therefore not a takeover plot.

They are a pragmatic effort to mobilise capital at a scale that Springfield alone cannot shoulder promptly, accelerate development so that Ghanaians can benefit from the resource sooner and strengthen GNPC’s technical capacity by increasing its stake in a viable producing asset.

If this process succeeds, GNPC will deepen its operational experience, and Springfield will gain the financial reinforcement needed to advance the block.

The government’s facilitation should therefore be commended.

It signals a strategic intention to support local champions, not undermine them.

It also positions Ghana to exercise greater sovereignty over its resources.

Setting the tone for Ghanaian ownership of the economy

Springfield’s story represents a turning point in Ghana’s economic evolution.

For decades, Ghanaian participation in major sectors—gold mining, oil and gas, telecoms, hospitality and manufacturing—has been minimal at the ownership level.

The narrative has often been one of foreign dominance, foreign capital and foreign expertise.

Springfield breaks that narrative.

Its achievements prove that Ghanaians can own and operate multi-billion-dollar assets.

Ghanaian companies can oversee highly technical operations with global safety and performance standards.

Indigenous entrepreneurship can coexist with foreign investment, creating a more balanced and inclusive economy.

The psychological impact of this is enormous.

Springfield’s success becomes a template for future Ghanaian champions in mining, agribusiness, aviation, manufacturing, digital technology and green energy.

A national asset that must be protected and elevated

Springfield has already done the impossible. It has crossed the technical, financial and operational thresholds that many believed were beyond the reach of a Ghanaian-owned company.

The company should be celebrated—not undermined. It should be supported—not doubted.

The government’s initiative to help Springfield transition to the next phase—whether through equity participation, new partnerships or financing support—must therefore be understood as a prudent national strategy.

Ghana cannot build an economy dominated by Ghanaian champions if it fails to nurture the few indigenous companies that have already achieved the impossible.

A defining moment for Ghana’s economic independence

Springfield Exploration and Production Limited, under the leadership of Okyere, has rewritten what is possible for indigenous participation in Ghana’s most technologically demanding sector.

Its achievements are not simply corporate milestones—they are national achievements.

Springfield stands as proof that Ghanaian ownership of key sectors is both feasible and desirable.

The ongoing government-backed discussions must therefore be seen as an effort to strengthen—not replace—indigenous participation.

They offer a path to accelerate production, deepen local capacity, and anchor economic value within Ghana.

At a time when African nations are rethinking how their natural resources can drive inclusive development, Springfield’s story is a beacon.

It demonstrates that with vision, boldness, technical competence, and strategic partnerships, Ghanaian companies can achieve global standards.

Okyere has built a national asset. It is now up to the Ghanaian government, regulators and citizens to ensure that Springfield is not only protected but elevated, so that the next generation of Ghanaian entrepreneurs can dream even bigger.