In July 1965, Ghana introduced its own currency — the Cedi — marking a significant milestone in the nation’s economic sovereignty.

Sixty years later, the Ghana Cedi stands as both a symbol of national pride and a reflection of the country’s complex economic journey.

As the Cedi turns 60, it is worth revisiting its origins, evolution, and what the future holds for Ghana’s monetary landscape.

Birth of the Cedi

The introduction of the Cedi in 1965 replaced the Ghana Pound, which had been in circulation since independence in 1957.

This change was part of the post-independence government’s effort to assert economic independence from British colonial influence.

The name “Cedi” was derived from the Akan word “sedie”, meaning cowry shell — a nod to the traditional medium of exchange used in pre-colonial Ghana.

Initially pegged to the British Pound and later the US Dollar, the early years of the Cedi reflected optimism and national pride.

The currency symbolised Ghana’s confidence as one of Africa’s most promising economies under President Kwame Nkrumah.

Years of turbulence and reforms

The decades that followed, however, were marked by economic instability. Political upheavals, inflation, and fiscal mismanagement in the 1970s and 1980s severely eroded the Cedi’s value.

Ghana underwent several currency redenominations and reforms to restore confidence in the national currency.

1967: The New Cedi (N¢) replaced the original at a rate of 1 new Cedi = 1.2 old Cedis.

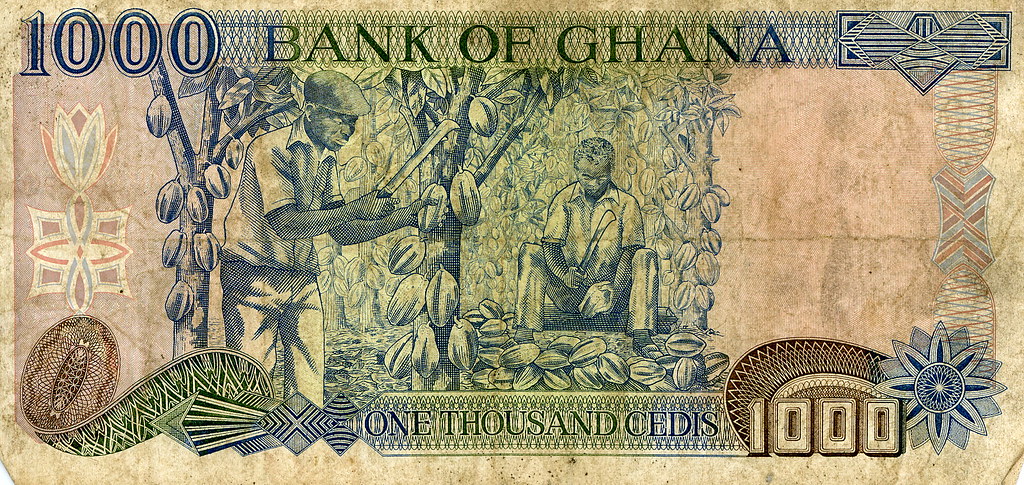

2007: The most significant redenomination occurred when the Ghana Cedi (GH¢) replaced the previous Cedi at a rate of 1 GH¢ = 10,000 old Cedis. This move, led by the Bank of Ghana, aimed to simplify transactions and stabilise public confidence.

Despite these efforts, challenges persisted — driven by global economic pressures, rising import dependence, and fluctuating commodity prices.

The modern cedi and digital evolution

In recent years, the strength of the Ghana Cedi has faced renewed volatility amid global inflation and exchange rate pressures. Yet, the story of the modern Cedi is not one of despair alone.

The Bank of Ghana has embraced innovation and regulatory reforms to strengthen the financial system.

Initiatives such as the Ghana Interbank Payment and Settlement Systems (GhIPSS) and the E-Cedi pilot reflect the country’s push toward digital finance.

The proposed E-Cedi, a central bank digital currency (CBDC), could position Ghana as a leader in Africa’s digital monetary transformation.

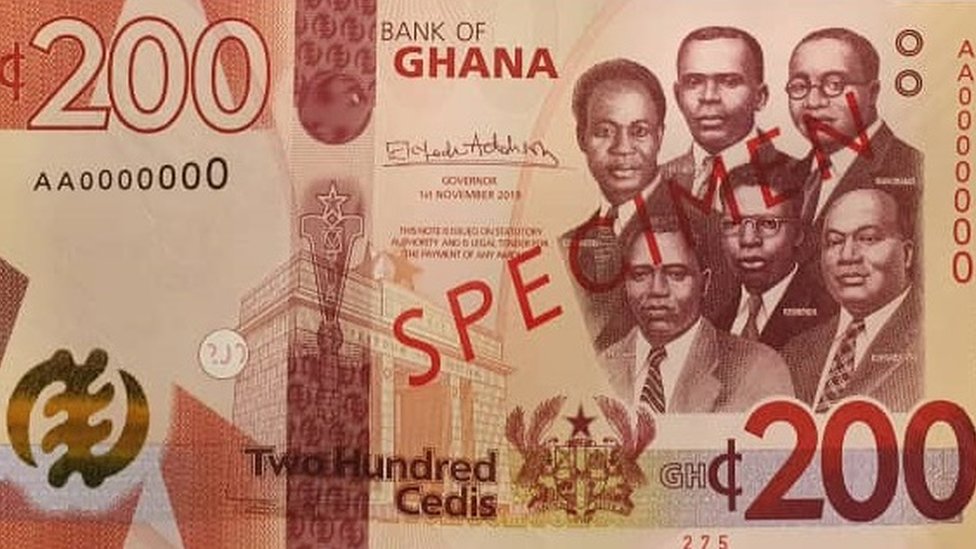

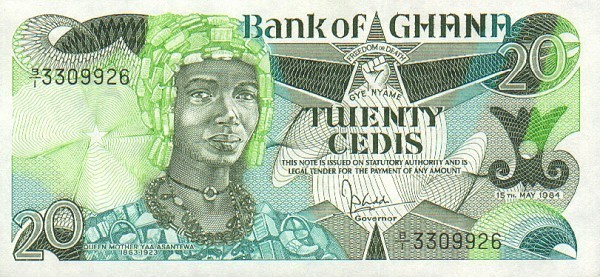

Symbol of national identity

Beyond economics, the Cedi remains a cultural emblem. Its notes and coins feature Ghanaian leaders, landmarks, and national symbols — reminding citizens of their shared history and aspirations. The Cedi’s endurance through six decades of economic highs and lows mirrors the resilience of the Ghanaian spirit itself.

Looking ahead

As Ghana navigates its future amid global uncertainty, the 60th anniversary of the Cedi invites reflection and renewal.

Strengthening fiscal discipline, boosting local production, and sustaining confidence in the banking system will be key to preserving the Cedi’s value and legacy.

The journey of the Ghana Cedi — from cowry shells to digital currency — encapsulates 60 years of transformation and strength. It is a story not just of a currency, but of a nation continually striving for stability, growth, and self-determination.